Oil Sets New 5-Month High

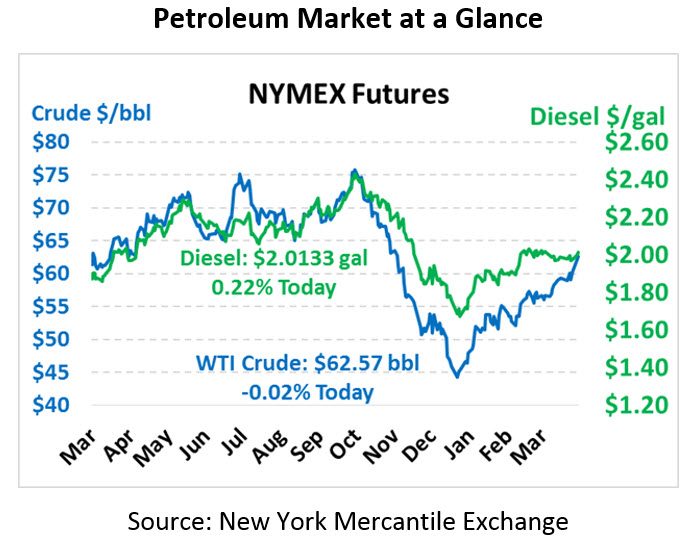

Oil is continuing its return to 2018 levels, erasing the losses of Q4 and closing yesterday at the highest level since early November. This morning prices are flat in anticipation of the EIA’s market report. Crude is currently trading at $62.57, unchanged from yesterday’s close.

Fuel prices are trading just mildly higher thanks to supportive API data. Diesel prices are currently $2.0133, up 0.4 cents. Gasoline prices are $1.9342, up 0.6 cents.

The API’s data released yesterday showed strong draws in petroleum products, though a surprise build in crude stocks is giving markets pause this morning. Declining exports from Saudi Arabia and other OPEC countries remains the focal point of markets, along with supportive economic data from China. Still, with oil prices up several dollars in just a few days, markets will need more supportive data from the EIA to sustain high prices.

Vice President Mike Pence noted yesterday that while oil prices are still a concern for the administration, so far fuel prices have been “quite competitive” for some time, meaning the US can continue cracking down on Iran and Venezuela. Pence also shared the US is “on track” for cutting Iran’s oil exports down to zero, indicating that some countries who had received waivers were not using them. Venezuela has been struggling with power outages that have limited oil output even further, keeping steady upward pressure on energy prices.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.