Week in Review

For the week, the crude oil market was up. Early in the week, poor economic data brought the market down, as did a surprise inventory build reported by the EIA mid-week. The bulls came back to end the week on the tails of positive news from the U.S. – China trade negotiations.

China proposed further reforms to appease U.S. negotiators and both sides seem eager to strike a deal. Such a deal would be a shot in the arm for the global economy and the crude market. Looming in the back ground are the Iran sanction waivers expiring in May. The expectation is that the waiver recipients will ask to extend the waivers and all eyes are on the Trump administration where there seems to be some disagreement on whether to extend waivers and keep oil prices low or to put pressure on Iran to bring about a nuclear deal and risk rising oil prices. Thrown into the mix this time around is the decimated oil production of Venezuela.

In addition, Russia and OPEC+ have recently reaffirmed their commitment to cutting supply to the agreed upon levels with Saudi Arabia going beyond their commitments in an effort to raise prices. Trump has tweeted to the Saudis to bring down prices, but the U.S. may not be able to count on the Saudis to increase production this time around as they had last year.

Prices in Review

Crude opened this week at $58.98. The week began relatively flat on Monday, giving way to an upward trend until mid-week where inventories were distorted by the shutdown of the Houston Ship Channel following a chemical spill. The surprise crude build was bearish for the market, but as the week closes, the bulls seem to have gained ground again. Today the market opened up for the week with WTI opening Friday at $59.53, a gain of 55 cents (0.9%) for the week.

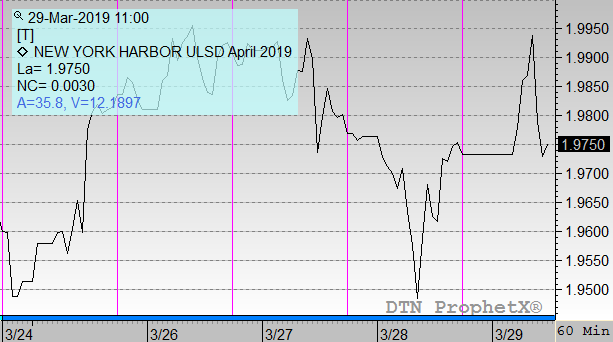

Diesel opened the week at $1.9591. It dipped on Wednesday, perhaps due to the EIA reported draw (-2.1 MMbbls) being less than half what the API (-4.3 MMbbls) had predicted. Diesel opened Friday at $1.9763, a gain of 1.7 cents (0.9%).

Gasoline opened the week at $1.9259. It followed diesel’s bearishness Wednesday and Thursday and could not recover by Friday. It opened Friday at $1.8943, a loss of 3.2 cents (-1.6%).

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.