US-China Trade Shows Progress

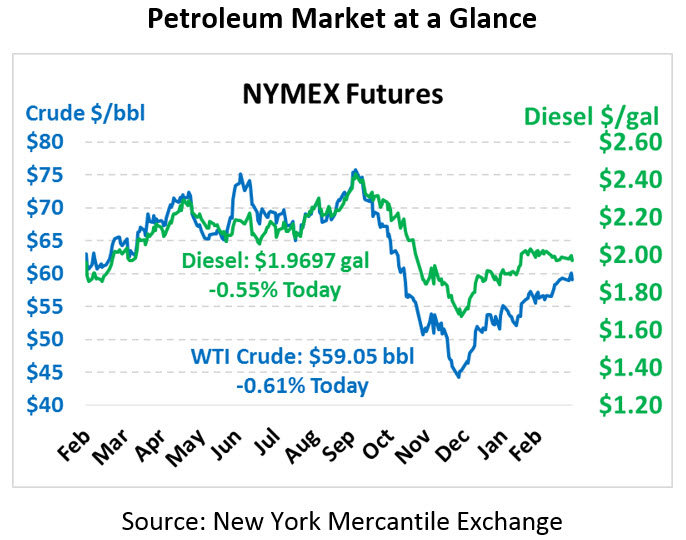

Oil turned lower yesterday following the EIA’s report, with losses continuing this morning. Prices saw sharp declines earlier in the day before bouncing a bit higher, though overall prices remain lower relative to yesterday’s close. Crude oil is currently trading at $58.86, down 55 cents from Wednesday’s close.

Fuel prices both declined as well yesterday, though diesel’s 1 cent dip was small compared to gasoline’s sizable 6 cent drop. Today, diesel prices are down to $1.9574, down another 2.3 cents. Gasoline prices are trading at $1.8601, down 3.5 cents.

Markets took yesterday’s EIA report as generally bearish as crude stocks climbed counter to market expectations. Still, weak refinery utilization led to decent draws in refined product inventories. The temporary closure of the Houston Ship Channel had a mild effect on imports and exports, but markets expect to see most of the impact in next week’s report.

Reports are indicating that US-China trade progress has picked up in recent days, with China proposing further reforms to appease US negotiators. Both countries are keen to strike a deal, particularly in light of recent import/export data showing the fastest decline in almost two decades. If tensions are resolved, a deal could provide a shot in the arm to a floundering economy, though some experts warn such a boost would be temporary. US Trade Representative Lighthizer and Treasury Secretary Mnuchin are in Beijing this week to resume talks.

Markets floundered this morning following a tweet from President Trump stating, “Very important that OPEC increase the flow of Oil. World Markets are fragile, price of Oil getting too high. Thank you!” Trump has sent several similar messages this year, though follow-through has been lacking overall. Markets will be anxious to see if any new action comes as a result of this tweet.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.