API Shows Large Surprise Crude Draw

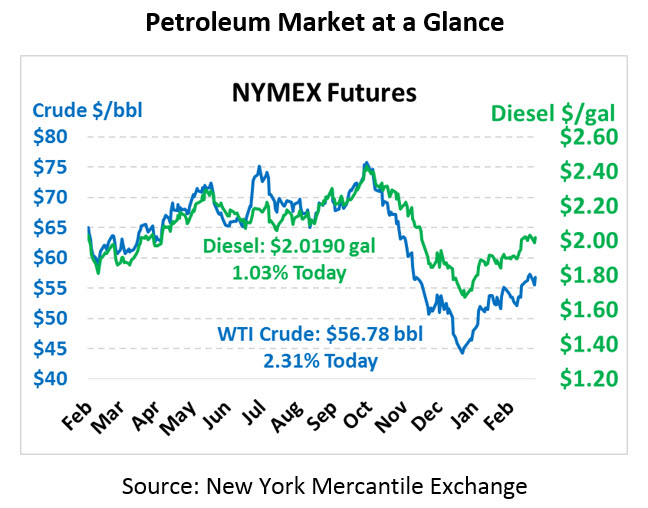

Crude oil is making a strong comeback from Monday’s sell-off. While crude oil prices yesterday saw hardly any movement until after-hours trading, fuel prices saw large gains that are continuing today. As we shared yesterday, nothing fundamentally changed on Monday, so traders are once again feeling the pressure to send prices higher. Crude oil is trading at $56.78 this morning, up $1.28 (2.3%).

Yesterday brought some steep gains for fuel prices, with diesel prices gaining 2.4 cents and gasoline rising 4 cents. This morning, markets are building on those gains. Diesel prices are trading at $2.0190 this morning, up 2.1 cents (1.0%) from yesterday’s close and back near 2019 highs. Gasoline prices are just a penny away from 2019 highs, trading at $1.6164 after picking up 3 cents (1.9%).

The API’s report gave markets a shot in the arm yesterday afternoon. The delta between market expectations and API forecasts for crude stocks reached 7 million barrels; while markets expected a medium build, they received a large crude draw. The surprise build in diesel stocks was not enough to counteract the strongly bullish impression received from the API’s data. This morning, the EIA will release its inventory data, which may or may not confirm the API’s numbers.

In reaction to Trump’s tweets against OPEC, Saudi energy minister Al-Falih shared, “All of the outlooks I have seen tell us that we will continue, we’ll need to continue, to moderate production in the second half of this year.” The OPEC+ agreement extends through the first half of 2019, requiring an extension to remain in effect for the latter half of the year. Whether the group cuts or not will be dependent on market conditions later this year – with Iran, Venezuela, and Libya all facing production outages, the group may decide to revise its production quotas slightly higher. With Saudi Arabia eying $80/bbl crude this year, you can expect they’ll hold steady with production cuts for the foreseeable future.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.