Sticks and Stones

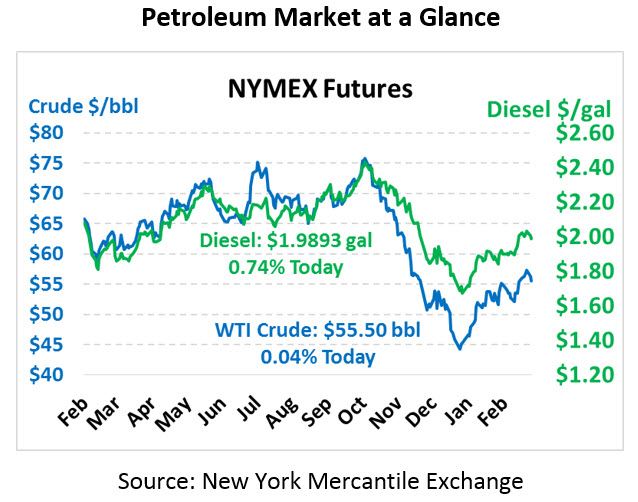

The President’s tweet yesterday caused a ripple effect through oil markets. (It’s a bit scary how normal that sentence sounds now.) Crude oil shed almost $2/bbl, and fuel prices sank by over 5 cents. Crude oil prices are trading at $55.50, roughly flat with yesterday’s closing price.

Unlike crude, fuel prices are rebounding from yesterday’s sell-off. Diesel prices this morning are trading at $1.9893, up 1.5 cents from Monday’s close. Gasoline prices are $1.5665, up 2.1 cents.

Was Trump’s tweet a shot in the dark? OPEC doesn’t seem to be taking any action after Trump gently prodded them for higher production levels. It seems bizarre that oil markets would fall $2/bbl (over 5 cents per gallon for fuel!) merely on account of a few vaguely threatening words from the President. During the Khashoggi incident, Trump made clear that defense ties with Saudi Arabia dominate our relationship; it seems the Saudis expect similar inaction over oil. It seems it’s time to update that common refrain heard in school yards: “Sticks and stones may break my bones, but tweets can never hurt me.”

Outside of Trump’s tweet, the news yesterday was generally bullish. Libya’s largest oil field remains under force majeure, with the National Oil Company refusing to restart production until rebel forces vacate the field. Production in some areas of Venezuela have shut down amid lack of diluents (light oils from the US used to help their heavy crude flow more freely). Trump has extended his deadline for imposing tariffs on China, and talks seem to be making progress.

With all factors pointing towards higher prices, and the one bearish headline seemingly just a shot in the dark, why did oil fall so quickly yesterday? It’s most likely that yesterday’s sell-off was simply a strong round of profit-taking. Oil prices have been rising steadily since the end of December when prices briefly dropped below $45. Those who bought at the low held their position until they saw a dip – and yesterday’s sell-off gave them a reason to sell their own stakes and lock in profits. The fundamentals of the market seem to consist of bullish factors, and despite the sell-off, nothing materially changed yesterday in the forward outlook.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.