Nigeria Election Approaches – Oil Risks

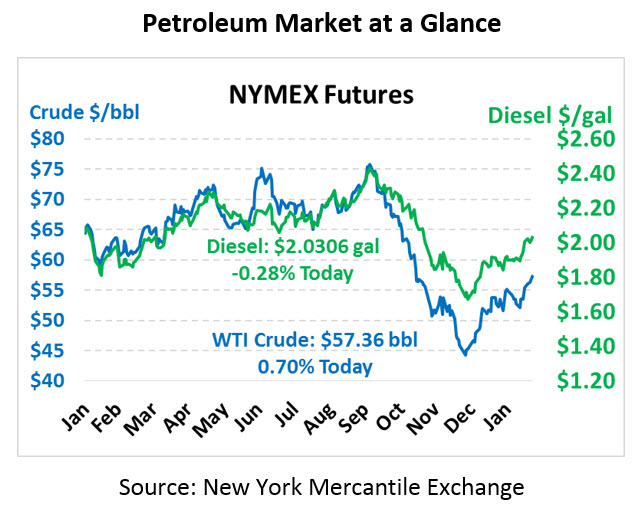

Oil prices began the day on the upswing, but late-morning trading have flipped fuel prices to the red and significantly dampened crude’s gains. We’re just one week away from Trump’s imposed deadline for US-China trade talks, and markets seem to be getting rattled. Crude oil is currently trading at $57.36, up 40 cents since Thursday’s close.

Fuel prices are trading a bit lower this morning, though both gasoline and diesel prices seem on track for large weekly gains. Diesel prices are trading at $2.0306, down 0.6 cents from yesterday’s close. Gasoline prices are $1.6073, down 0.7 cents since yesterday but up 3.5 cents for the week.

The EIA released its weekly inventory data a day delayed, showing fairly benign changes in oil inventories. Cushing crude stocks rose 3.4 million barrels for the week, which is bearish for WTI crude, but the build was expected following Keystone pipeline issues. Refinery utilization remained low as refineries go through scheduled and unscheduled maintenance before the summer demand season. Crude exports hit a record high 3.6 million barrels per day, thanks to fog the week prior forcing shippers to delay exports.

Nigerians go to the polls this weekend to vote on their next president. Few Americans take note of this important election, but it actually could be quite significant to oil prices. President Buhari is the front-runner to win reelection, but the rebel group Niger Delta Avengers have promised to disrupt oil flows if he wins. With markets already fairly tight thanks to Venezuela sanctions and OPEC cuts, any disruptions from Nigeria could cause significant short-term price fluctuations for oil.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.