Week in Review

This week saw markets turn to the uptrend, setting numerous new 2019 highs thanks to OPEC supply cuts. Nigeria signaled their support for balancing oil markets, and Saudi Arabia’s push for $80/bbl oil is keeping upward pressure on prices.

The Federal Reserve released the minutes from their recent meeting, and the takeaway was that the Fed will remain “patient” with current rates. The Fed also signaled that quantitative tightening, the unwinding of their massive balance sheet accumulated during the Great Recession, will continue, but could come to an end later this year.

With heightened potential for a recession this year, the Fed is evaluating its policy options. Typically, it could cut interest rates to reduce the impact of a slowdown, but cutting already-low interest rates will have a smaller impact than in past recessions when interest rates began at 5% or higher. The Fed is evaluating other options such as Quantitative Easing, Shadow Rates – even Negative Interest Rates.

For oil prices, a “patient” Fed means continued low interest rates, a lower US Dollar, and thus higher oil prices. Whether or not the Fed can avert an economic slowdown is of great importance to oil markets. A recession would cause oil demand to tank; during the 2008-09 Great Recession oil prices fell from $140 to $45 before rising again to $100 once the economy stabilized. A recession now could cause a steep decline in oil demand and prices.

Prices in Review

The oil complex got a huge boost on Wednesday as countries amid the release of FOMC minutes and countries like Nigeria getting on board with continued (deeper?) production cuts. Crude oil opened the week on Tuesday (having traded only a partial day on Monday) at $55.78. After a big leap on Wednesday, prices set new 3-month highs. Crude opened this morning at $56.84, a gain of $1.09/bbl (2.0%).

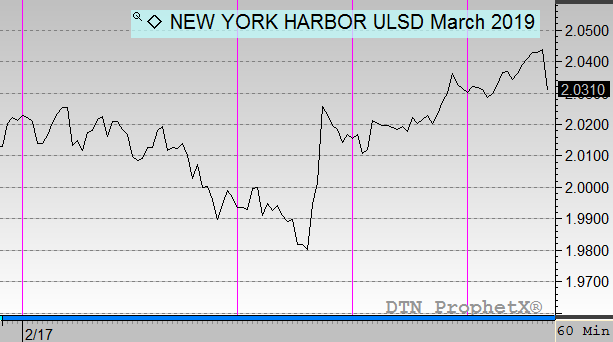

Diesel prices opened on Tuesday at $2.02 – up to then the highest opening price of the year. Prices saw some weakness as markets feared a small-ish inventory draw, but Wednesday’s oil gains brought the product back to where it began. The EIA’s data on Thursday showing a medium-size draw supported prices, and this morning diesel opened at $2.03, a net gain of 1.1 cents (0.5%).

Gasoline prices saw perhaps the most significant gains of the week, as low refinery utilization and anticipated summer demand are generating strength. Gas prices opened the week at $1.5728, leapt three cents on Wednesday, and opened this morning at $1.61 – a gain of 3.7 cents (2.4%).

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.