Elections, Sanctions and Waivers – Oh My!

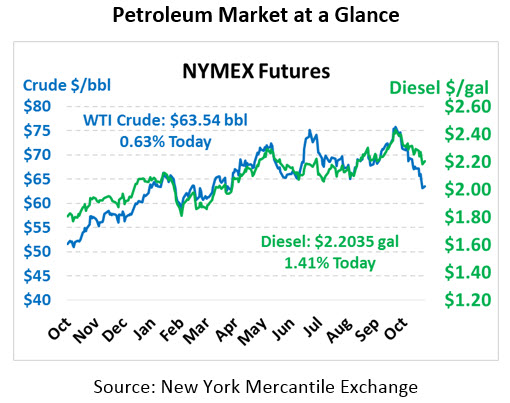

Markets are experiencing a slew of uncertainties, setting the stage this week for price volatility. After some steep losses last week, oil prices are trading slightly higher this morning. Crude oil is currently trading at $63.54, up 40 cents.

Fuel prices are mixed this morning. Gasoline prices are $1.7043, down 0.4 cents since Friday’s close. Diesel prices are trading at $2.2035, up 3.1 cents (1.4%).

Iran sanctions are officially in full effect as of this morning, so it’s now a count-down until the next round of global oil reports (expected in early December from the IEA, EIA and OPEC) to see how sanctions impact supplies. Eight waivers were granted by the Trump administration to countries like South Korea, India, China, Turkey, and more. The waivers only apply for 6 months, kicking the can farther down the road to allow countries to phase out all production. Already, Iran exports have fallen significantly ahead of sanctions, so markets are expecting the outage to cut global supplies by at least 1 million barrels per day.

Domestically, markets are awaiting the results of the mid-terms, which will be highly influential in setting future energy policies. For a full analysis of energy impacts, check out our October coverage: Midterm Elections – What’s at Stake? A Democratic win in the House would create political gridlock that would significantly hinder Trump’s legislative agenda – preventing fast action on energy as well as economic policies. If the Republicans win, expect a repeat of the first two years of Trump’s term, with the added boost of an approving nod from voters. We’ll know more tomorrow after the midterms elections take place. Go vote!

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.