Get Out the Vote!

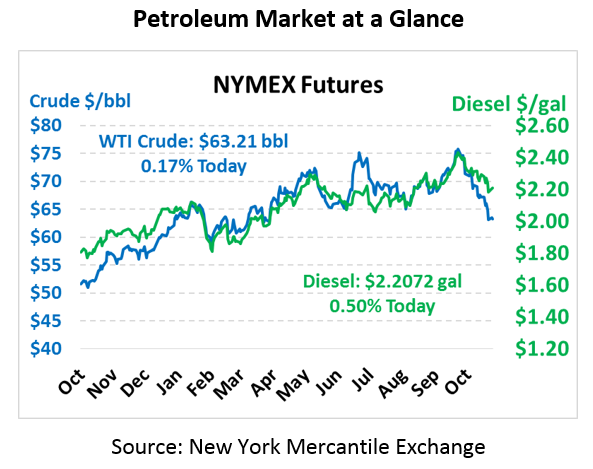

Oil prices began yesterday on a high note but ultimately ended flat to Friday’s close. This morning, prices are waffling – markets still fear weakened demand prospects, but supplies appear to be moving towards tightening again. As we noted before, this week’s sub-$65 prices are the lowest since April. Crude oil is trading flat once again this morning, at $63.21.

Fuel prices have also been set back somewhat. Diesel prices have outperformed other products and far from the $1.85 low set earlier this year. Gasoline prices, on the other hand, are at levels not seen since February and quite near the $1.67 annual low. Today, both products are in the black. Diesel prices are currently trading at 2.2072, a gain of 1.1 cents. Gasoline prices are $1.6958, up 0.4 cents.

Markets will likely continue to search for direction today, awaiting today’s election results. On the demand side, markets basically view the election results as a draw – on some analysts have noted, Wall Street tends to prefer gridlock in Washington as it provides a level of predictability. However, with another government shutdown pending on Dec 7 and a debt ceiling debate on March 1, gridlock could create at least a few temporary sticking points for the economy. A Republican win would be positive for oil drillers and refineries, but could also be viewed as giving Trump a mandate to ramp up his trade war efforts.

On the supply side, there are questions whether Trump will continue pressuring OPEC to up its production after the midterms. Many have noted Trump has conveniently increased his tweeting @OPEC as the midterms approach – it’s at least possible that Trump will back down and focus on other issues after midterm elections calm down. With OPEC meeting later in November to discuss extending production quotas, it’s possible the group could decide to extend quotas further to keep prices elevated. OPEC members have generally expressed support for Brent prices in the $70-$80 range (for WTI, that’s a $60-$75 range depending on Brent-WTI spreads) so the group is expected to maintain its swing producer status in 2019.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.