Today’s Market Trend

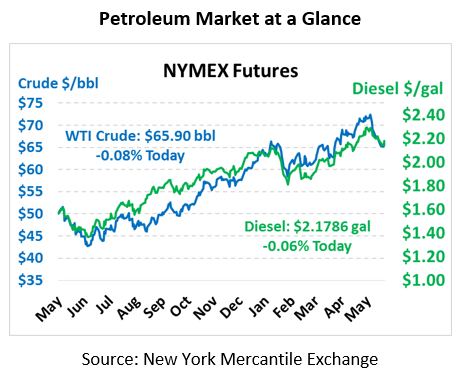

Crude oil prices rose yesterday, recuperating the previous day’s losses, with prices peaking as high as $66 before falling lower to close at $65.95. Of course, this is $5 lower than prices were just two weeks ago, a significant decline over a short period. With markets antsy leading up to the June 22 OPEC summit, expect prices to remain volatile until more concrete news is announced. Today, oil prices are down slightly, trading 5 cents lower than yesterday’s closing price, at $65.90.

While crude prices received moderate support yesterday, fuel prices saw huge price increases. NYMEX diesel prices rose over 5 cents yesterday, while gasoline gained 4.5 cents. Today, diesel prices have stagnated, moving a few points lower down to $2.1786. Gasoline picked up a quarter of a cent, trading at $2.1173 this morning.

The market’s selloff has been almost entirely the result of renewed focus on OPEC – a dynamic that hasn’t been in play for quite a few months. When OPEC was discussing production cuts, there were weekly snippets from OPEC members saying they agreed or disagreed with cuts, creating a buzz that sent prices soaring before any cuts were made. Now that they’re considering a cut, markets are once again chasing any headline related to the decision.

Of course, the decision won’t be an easy one. While Saudi Arabia and Russia have the capacity to increase production and have supported higher outputs, other OPEC members, especially Iran and Iraq, have expressed disapproval. With production in those countries limited, they need higher prices to balance their budgets. And with prices trending lower already, Saudi Arabia and Russia may feel the need to temper their desire for higher outputs, preferring to keep prices in the $70 range. Saudi Arabia, at least, remains focused on the public offering of their national oil company, so their national agenda is biased towards needing higher oil prices.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.