Week in Review

After significant losses last week, prices have been relatively stable this week, trending around $64-$66 per barrel for WTI crude. Interestingly, Brent crude oil has been over $10 higher than WTI this week (for context, we wrote about “high” spreads spurring exports when Brent rose to $5 above WTI last year). The mismatch shows that Eastern Hemisphere markets are responding to sanctions on Iran by scrambling for new supply, while the Western Hemisphere has been insulated from such pressure. Fuel prices have also taken a hit over the past two weeks, but began to recover somewhat on Thursday with large gains.

Is $65-$75 Oil Sustainable?

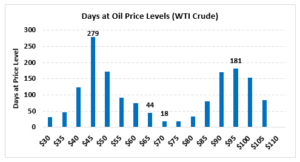

It’s worth noting that over the past five years, pricing trending around $65-$75 has been quite rare. When you consider the number of days prices have spent in that price range since the beginning of 2012, only 18 days closed between $70 and $75, and only 44 days closed between $65-$70. Out of the 1,600 trading days in this 5 ½ year period, only 4% have been in the $65 to $75 range.

What does this mean for prices? This $65-$75 tends to be an area of quick movement – prices either rapidly falling lower or rapidly rising even higher. Based on these historical trends, it appears likely that we won’t remain at this level for long – prices will seek higher ground or revert back towards the $40-$55 level. Given the steep increase over the past year and a half, prices falling back to such low levels

The confounding factor to this analysis is changing technology and market conditions. Some analysts have said the days of $100 oil are gone forever thanks to fracking technology changing the equation for producers. If this is the case, then $70-$80 could be the new $100 oil, with prices remaining lower thanks to technology. This still requires that the new oil being produced can get to market – we’ve seen crude oil fracking in West Texas create so much supply that it can’t get to market fast enough.

So in brief: If prices remain at their current levels, it would be an anomaly. It could happen due to changing technological factors, but we’ll be in new territory if we remain here, and new territory means volatility.

Price Review

Crude oil remained relatively steady this week, trading between $64.50 and $66.00 for most of the week. Crude opened the week at $65.71, trading up and down throughout the week as various headlines spurred traders higher or lower. The EIA’s report of across-the-board petroleum product builds last week contributed to a sell-off on Wednesday, but Thursday saw prices climb to a weekly high of $66. Prices opened this morning at $65.98, yielding little change from the week’s opening price.

Diesel prices saw slightly bigger swings this week, reacting to inventory data expectations. Prices fell on Tuesday in concert with crude oil, but began rising in the afternoon following the API’s report of a diesel stock draw. The EIA reversed these expectations, showing a larger than expected build in inventories, causing prices to fall four cents on Wednesday. Thursday brought renewed exuberance in the market as traders bought the dip, sending prices five cents higher. The week opened at $2.1723, and this morning’s opening price was $2.1821, a mild penny gain for the week.

Gasoline saw the most volatility this week, and was the only product to end in the red. Gasoline prices opened Monday at $2.1400, and steadily fell Tuesday and Wednesday amid reports of large gasoline builds – an anomaly following Memorial Day weekend and in the middle of summer driving season. Thursday saw prices rise along with the rest of the market, but the four cent gain was not enough to put the week in the black. Gasoline prices opened this morning at $2.1176, a loss of 2.24 cents (1%).

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.