Today’s Market Trend

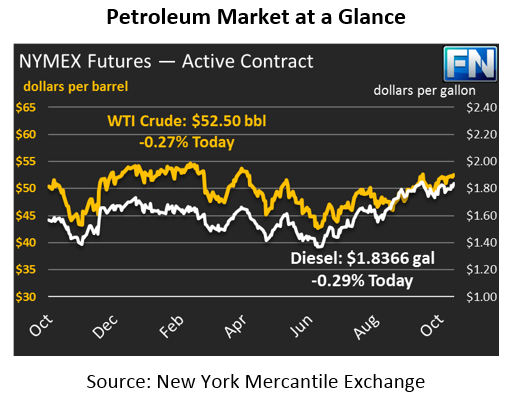

Markets saw a sharp increase during yesterday’s trading session, with all products moving higher. Markets have cooled off a bit this morning, though remain elevated. Crude oil went from $52.19 to $52.64, a 45 cent (+0.9%) gain. Yesterday’s close once again marketed the highest closing price since April 2017, six months ago. Prices are slightly lower this morning, giving up 14 cents of those gains to reach its current level of $52.50.

Diesel prices outperformed crude oil, picking up 2.2 cents (+1.2%) yesterday to reach $1.8419. The last time diesel prices closed over $1.84 was Sept 27, exactly one month ago. Today, diesel prices are down half a cent to $1.8366.

Gasoline prices more closely tracked crude’s gains yesterday, picking up 1.6 cents (+0.9%) to close at $1.7506, the highest closing price since gasoline surpassed $$2.00 during Hurricane Harvey. Prices have already given up 1.4 cents of those gains, falling to $1.7367 this morning.

Markets got a shot in the arm yesterday from comments from Saudi Arabia’s Crown Prince that the OPCE cuts should be extended through the end of 2018, which would be a 9-month extension. Both Saudi Arabia and Russia have issued several comments indicating their support for an extension, and markets are beginning to price an extension into their expectations.

The U.S. Dollar Index is trading at its highest level since July, spurred higher by the European Central Bank’s decision to extend its easing policies. The passage of a budget resolution in the House is also contributing to the dollar’s gains. A rising dollar puts negative pressure on oil prices, so expect to see the large dollar gains create significant headwinds for crude today.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.