Week in Review

Crude oil prices have risen gently this week, while refined products have seen significant gains, particularly in gasoline. Crude markets have increased by 73 cents (+1.4%) between Monday’s opening price and Friday’s, with Friday prices starting the day at $52.80, though trending down to close the week.

Diesel picked up 3.1 cents (1.7%) this week, opening Friday at 1.8419. Diesel prices were supported by a large stock draw reported by the API and EIA, but struggled to hold on to those gains during the week. In general, diesel has tracked underlying crude prices closely.

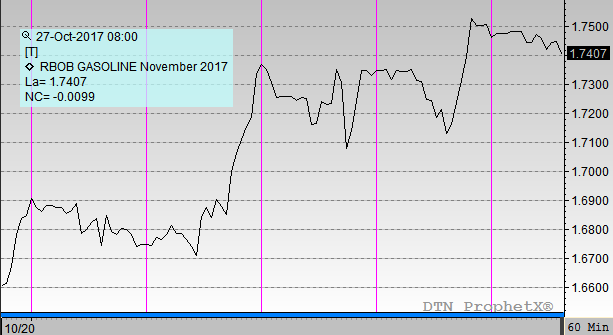

Gasoline is by far the biggest winner for the week, picking up 6.9 cents (+4%) to open Friday at $1.7529. Gasoline demand was much higher than expected this week, which combined with a steep stock draw helped to boost prices significantly. While some had ruled out the possibility of a gasoline price rally, this week showed that gasoline prices can still keep pace with rising diesel prices. Gasoline support has also come from rising RINs prices, which increase the price of feedstock RBOB products.

Diesel crack spreads, the difference between a barrel of diesel and a barrel of crude oil, have been elevated at two-year highs for over a month now, and it looks like gasoline might be creeping up as well. Gasoline crack spreads have averaged roughly $15-$20 over the past few years, and this week they creeped up over the $20 level. Diesel has been in the $23-24 range for the past month, though it averages in a similar range to gasoline (roughly a $15 average).

The main news events of the week were the significant stock draws for diesel and gasoline announced by the API and confirmed by the EIA. At the same time though, oil production has soared back to normal, gaining 1.1 million barrels per day over last week, when Hurricane Nate forced some production offline. Exports remain high, buoyed by strong spreads between U.S. WTI crude prices and international Brent prices.

OPEC continues to make headlines, and this week was no exception. More countries have indicated support for a production cut extension. Markets are already beginning to price an extension into their expectations, so if OPEC fails to come through there could be some downside price risk. Earlier this week, the OPEC monitoring committee announced that September deal compliance, at least for OPEC members, was at 120%, thanks to deep cuts from Saudi Arabia.

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.