Nat Gas News – October 6, 2017

Nat Gas News – October 6, 2017

Tropical Storm Nate Threatens Oil Rigs in the U.S. Gulf

Bloomberg reports: Tropical Storm Nate has formed off of Nicaragua, threatening to inundate Central America, shut oil and gas rigs in the Gulf of Mexico and damage cotton and citrus crops across the U.S. South. There is about 45 percent chance Nate will disrupt energy production in the Gulf, said Matt Rogers, president of the Commodity Weather Group LLC in Bethesda, Maryland. But Rogers said he doesn’t see much chance for any lasting damage because Nate won’t be strong enough. Offshore rigs and platforms in the Gulf of Mexico account for about 17 percent of U.S. crude oil output and 4 percent of gas production. About 45 percent of petroleum refining capacity and 51 percent of gas processing is along the coastline. For more visit Bloomberg.com or click the following link https://bloom.bg/2hOhuSD

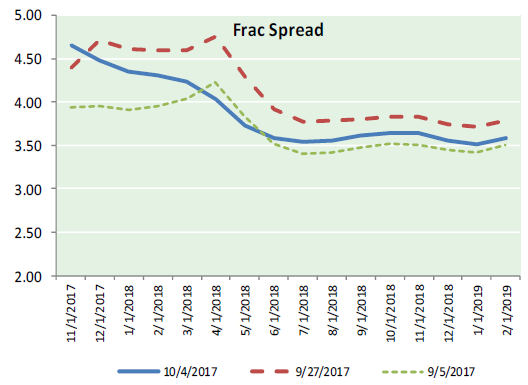

Inventories Spread: Could Natural Gas Make a U-Turn?

Market Realist reports: In the week ended September 22, 2017, natural gas inventories increased 58 Bcf (billion cubic feet) to 3,466 Bcf, based on EIA (Energy Information Administration) data. This increase was 19 Bcf less than the market’s expected increase. However, natural gas November futures fell 1.4% after the inventory report on September 28, 2017. The market expects a rise of 56 Bcf in the natural gas inventories level for the week ended September 29, 2017. During the same period in 2016, natural gas inventories rose 80 Bcf. However, any rise up to ~92 Bcf would not increase the inventories spread. Any rise that is less than 92 Bcf can narrow the inventories spread. For more on this story visit marketrealist.com or click the following link http://bit.ly/2y2WtJX

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.