Weekly Price Review

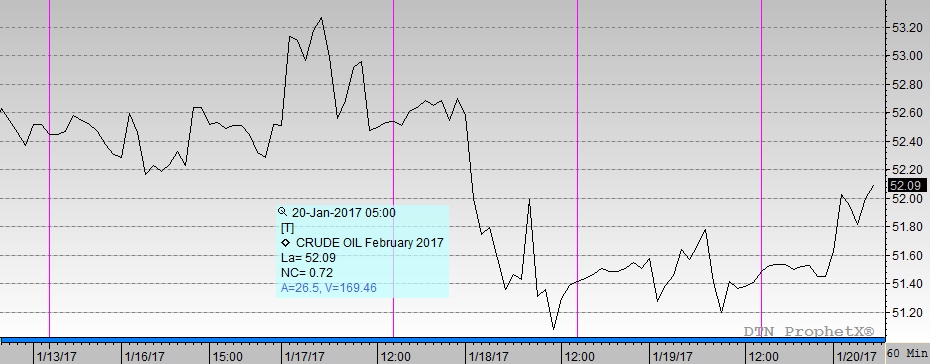

After weeks of upward momentum that could only be described as a non-starter, oil prices a firmly higher this week, drawing strength from the EIA’s impressive inventory report on Wednesday and strengthening fundamentals.

Crude prices gained over $3.50 (7.8%) this week from its opening price on Monday of $45.46/bbl. Prices opened this morning at $49.17/bbl, the highest opening price since May 31. Markets are watching to see whether crude can muster the strength to surpass $50/bbl; it may take fresh bullish news (perhaps a declining rig count number today?) to push prices higher.

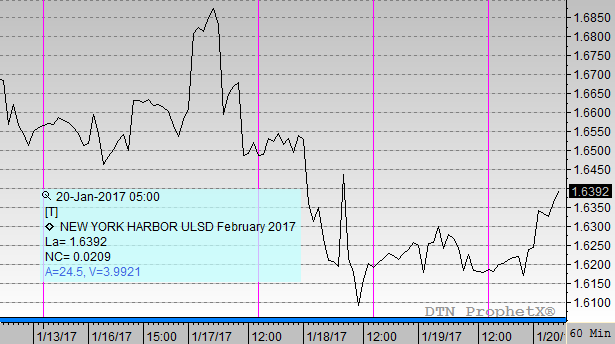

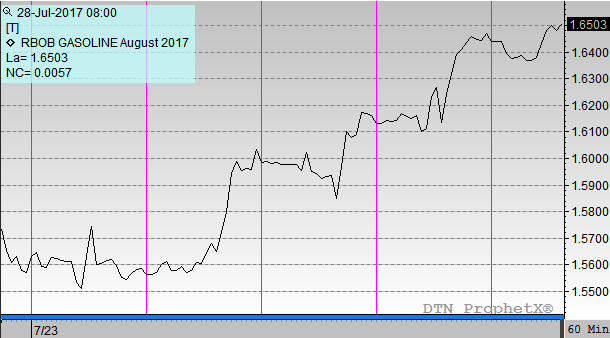

Refined products posted slightly lower gains, with gasoline gaining 5.5% ( and diesel gaining 6.0% between Monday and Friday’s opening price. Diesel and gasoline spreads narrowed during the week, coming within 2.2 cents of each other, but this morning gasoline was up nearly 4 cents above diesel prices. Finding comparably high diesel and gasoline prices requires going back further than crude markets, with refined products reaching their highest level since May 25.

The week started out with a supportive announcement from Saudi Arabia that exports would be cut in August to 6.6 MMbpd to help continue trimming down global inventories. Following this announcement, the UAE and Kuwait both announced cuts to their crude exports, demonstrating a commitment to the cuts just as traders were beginning to worry that the deal may unravel.

Of the $3.50 that crude markets gained this week, $2 were gained on Tuesday following the API stocks report, which showed a crude inventory draw of 10 MMbbls. The EIA’s data on Wednesday showed a slightly smaller—though still the second largest of the year—stock draw, helping to solidify gains from this week. Markets sustained their higher traders yesterday, showing a nominal gain of $.45.

If prices can maintain their current levels, this week will have brought the largest price gain in 2017. After weeks of slow growth and quick declines, market sentiment is beginning to turn more bullish, which many expected to happen in Q3 of 2017. While it’s too early to say that markets decidedly will rise high, the tone of the market has certainly shifted to a more bullish outlook.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.