Today’s Market Trend

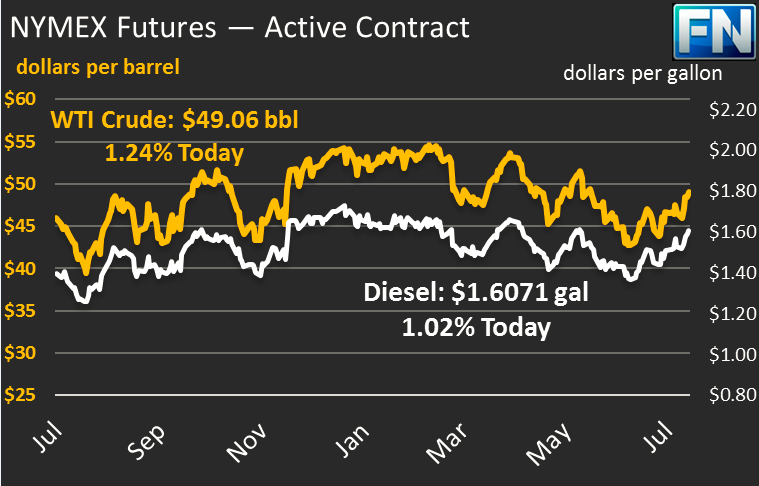

Crude prices broke through the $49/bbl threshold last night, and are currently at $49.06. Prices yesterday fluctuated between a low of $48.25 and $49.24, maintaining Wednesday’s gains and looking for more bullish news to justify a push to $50/bbl.

Refined products are also slightly higher this morning. Diesel prices have gained $.0039 (.24%) since yesterday to reach $1.6071, while gasoline gained $.0057 (.35%) to reach $1.6503.

Absent any major news, markets will likely fall somewhat today amid profit taking and shorts exiting the market. Venezuela holds their elections on Sunday, which the U.S. has threatened to follow up with sanctions. While Merrill Lynch analysts view the threat of sanctions as unlikely, they are still a possibility that could easily push prices above $50/bbl.

Numerous oil companies have shared their Q2 financial performance, with a common trend being cuts in exploration and production. Earlier this week, Halliburton told shareholders that exploration companies may be “tapping the brakes” on adding to the rig count. U.S. production has been growing at break-neck speeds, but it appears that momentum is beginning to fade. Some analysts forecast decelerating growth of U.S. production in the coming month, followed by slowly declining production, assuming prices remain at or below $50/bbl.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.