Nat Gas News – June 7, 2017

Nat Gas News – June 7, 2017

In the News

Unitil Files for an Increase in Natural Gas Distribution Rates for New Hampshire Customers

Nasdaq reports: Unitil Corporation (NYSE:UTL) announced today that its New Hampshire local natural gas distribution utility filed a rate case requesting approval to increase its natural gas distribution base rates with the New Hampshire Public Utilities Commission. Unitil has requested an increase of $4.7 million in base revenue, or an increase of approximately 7 percent over total operating revenue. The filing includes a request for temporary rates effective August 1, 2017. A final order on the filing is expected in mid-2018. The filing also includes a proposal for a multi-year rate plan which would provide for the recovery of costs associated with operational and safety related improvements and upgrades Unitil is making to its gas distribution system in New Hampshire over the next several years.

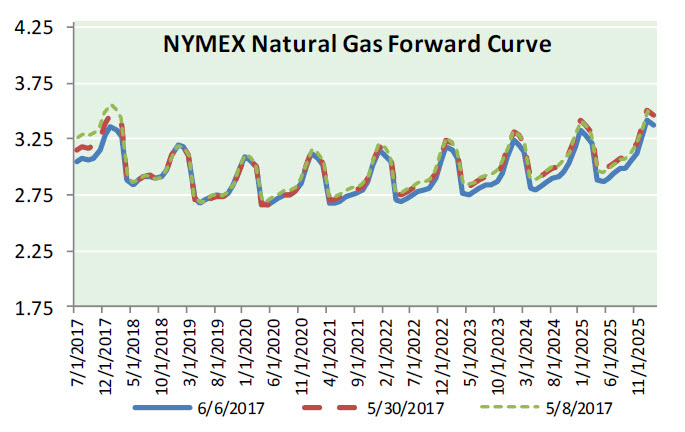

Natural Gas Prices Experience Reprieve from Selling

Economic Calendar reports: After five consecutive days of losses, natural gas prices are rebounding in today’s session, as the contract for July delivery on the New York Mercantile Exchange is currently trading at $3.039/MMBtu, a gain of 2.05% for the day. A rebound from the lows on Monday suggested the recent rout in natural gas prices may have been nearing at least a temporary end. In addition, the July contract has been extremely oversold since the end of May, signaling that the decline was overextended and that a rebound was likely to develop. Natural gas prices were boosted from the session lows on Monday by news that Saudi Arabia and key allies cut ties today with Qatar, the world’s top seller of liquefied natural gas.

This article is part of Daily Natural Gas Newsletter

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.