Today’s Market Trend

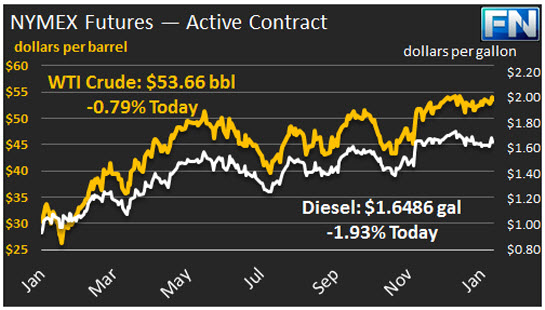

WTI crude prices are in the $53.50/b-$54.00/b range this morning. Prices yesterday were above $54/b for a time, but the market closed at $53.54/b. WTI opened at $53.68/b today, an increase of $0.11 from yesterday’s opening price. Current prices are steady at $53.66/b, $0.12 above yesterday’s close. Product prices have weakened.

OPEC’s production cuts are being given more credence this week upon independent surveys showing high levels of compliance. Reuters believes compliance rates are around 80%. Other factors supportive of prices: a weak U.S. Dollar, a steady course of monetary policy by the Fed, and heightened tension between the U.S. and Iran.

The supply-demand fundamentals are working to moderate prices. U.S. crude production is rising, and this week brought include another major inventory build. The EIA reported crude stock additions of 6.466 mmbbls, gasoline stock additions of 3.866 mmbbls, and distillate stock additions of 1.568 mmbbls. The EIA’s supply estimates show a drop in refined product supplied of 273 kbpd in January 2017 relative to December 2016.

The U.S. jobs report was just released, showing that payroll employment rose by a very strong 227,000 in January. The unemployment rate was 4.8%, relative to 4.7% in December.

Distillate opened at $1.6586/gallon in today’s session, down 1.23 cents from yesterday. Current prices are $1.6486/gallon, a slight decline of 0.32 cents from yesterday’s close.

RBOB opened at $1.536/gallon today, a significant drop of 4.39 cents from yesterday’s opening. Current prices are $1.5224/gallon today, down 1.05 cents from yesterday’s close.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.