WTI Crude Exceeds $30/bbl

Oil prices are swelling higher this morning on renewed optimism of a quick return to normalcy. OPEC+ supply cuts are helping to reboot oil prices, with the IEA forecasting May supply to fall by a historic 12 million barrels per day relative to April. The key question to evaluate now is when supply and demand will officially come into balance once again. Commerzbank suggests that threshold could come in June, though others suspect demand will take much longer to come in line.

As consumption returns, another important question will be how US producers respond. Shale production has been shrinking amid low prices, but now prices are beginning to move higher. As the world’s swing producer, America could unleash over 1.5 MMbpd of new production if prices rise high enough. But bringing that back online will require capital investments, meaning high rates will not be enough; high prices must also be sufficiently sustainable to encourage banks to loan more to risky oil companies.

Markets remain focused on the flotilla of oil making its way to the US from Saudi Arabia. Over 50 million barrels of crude oil are on track to arrive at US ports over the next 6 weeks, undoing recent declines in output. Trump has threatened to bar the oil from hitting American soil, and Saudi Arabia responded that they were ready to re-route the vessels if necessary. If the ships do offload into American inventories, analysts predict it could un-do declining production and result in hefty inventory builds for the next few weeks.

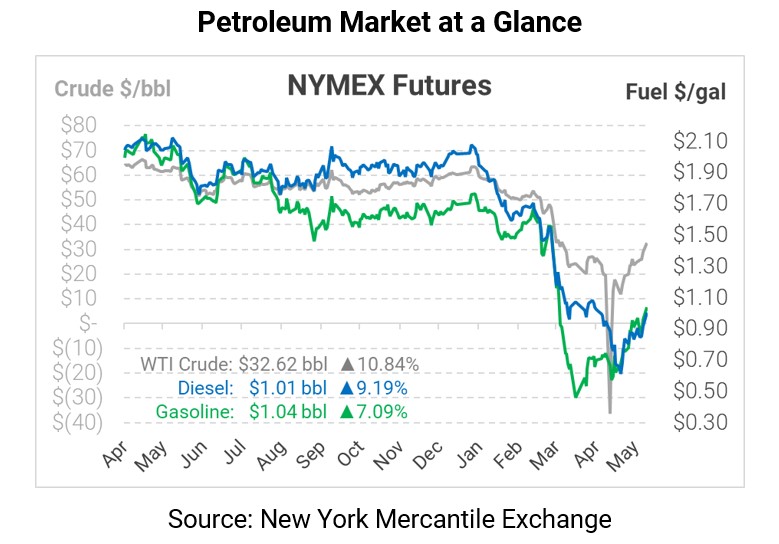

Crude oil is showing strong gains this morning as the market weighs optimistic prospects of rising demand and falling supply. WTI crude is trading at $32.62, a gain of $3.19 (10.8%).

Fuel prices are now trading above $1/gal for the first time in over a month. Diesel prices are currently trading at $1.0050, up 8.5 cents (9.2%) from Friday’s close. Gasoline prices are currently $1.0390, up 6.9 cents (7.1%).

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.