WTI Crude Closes -$36. Yes, That’s Negative

Yesterday, the bottom fell out of WTI Crude prices unlike ever before. Prices opened substantially lower, fell to the $.01 bargain bin, then crossed the fateful line into negative territory. But before you assume that fuel suppliers will start paying you to take their diesel and gasoline away, it’s essential to understand why the drop happened and how long it will last. PS – scroll to the bottom to read about today’s drop in fuel prices, which is spreading through the entire forward curve.

What Happened Yesterday?

Crude oil prices fell below $0/bbl for the first time in the crude futures market’s history as traders unloaded positions ahead of the May contract’s Tuesday expiration. The historic 305% drop to a price below zero means that sellers would pay to give away their crude. At the close, crude oil futures for May dropped to -$36.73 a barrel, the largest one-day sell-off ever of $55.90 per barrel.

It’s important to point out that no other product had such a historic day. Not even Brent Crude took the plunge yesterday, signifying that the market is most concerned with Cushing, OK crude storage rather than a broad oil glut. The June 2020 WTI Contract barely moved throughout the day, closing above (positive) $20/bbl.

Why Did Crude Go Negative?

Keep in mind, commodity futures contracts are simply agreements to take ownership of crude oil at a specific time (May 2020), place (Cushing, OK), and price. Millions of contracts change hands throughout the month, but at the end of the day, very few traders want to own physical barrels of crude. With the May 2020 contract expiring tonight, speculators began yesterday to unwind their positions so they could speculate on June 2020 contracts. This process occurs every month and has for decades, but this time there was a twist.

When sellers went to liquidate their position, they found that no one wanted to buy the contracts from them. With storage so tight and crude production so heavy, virtually no one was buying contracts, meaning speculators selling oil had nowhere to turn. Rather than taking the crude oil and scrounging for storage, traders pushed prices into the negative – paying others to take their crude for them.

Yesterday was not the first time a commodity’s price turned negative. Other energy commodities such as natural gas, propane, and electricity occasionally turn negative due to oversupply. At some points, physical crude oil prices in particular areas (think land-locked areas such as North Dakota) turned negative briefly to encourage sales.

Who Benefits from Negative Crude Prices?

First and foremost, negative crude prices benefit those with storage or the ability to move crude oil. Most producers trade in physical oil prices, rather than futures prices, so yesterday’s bizarre events won’t have a direct financial impact on producers. Still, it’s a strong signal to cut back on production to prevent further market price degradation. Refiners, paid to take crude oil and also paid to sell fuel, may produce excess fuel supplies in May to capitalize on the widening crack spreads.

Why Didn’t Gasoline and Diesel Prices Fall?

Diesel and gasoline prices fell yesterday, but only by a few cents. Fuel prices did not turn negative because refiners have been decreasing utilization as prices have been falling. Fuel storage space remains available as well. For consumers who are already seeing low prices, expect to see continued downward pressure at the rack and pumps in the short-term, but negative fuel prices are highly unlikely at this point.

What Does This Mean for Consumers?

Unfortunately, not much. Negative crude oil prices will be positive for refiners, but we have yet to see fuel prices erode as much as WTI crude. The fact that this was limited to Cushing, OK and not all crude oil suggests that the effects may not be global. While areas reliant on Gulf Coast fuel production – including the Gulf states, the Midwest, and the Southeast – may see prices fall as crude feedstocks cheapen, other areas should expect to continue paying typical rates. Of course, those “normal” rates are still highly discounted compared to pre-coronavirus times, so it’s not all bad news.

Today’s Market Trends

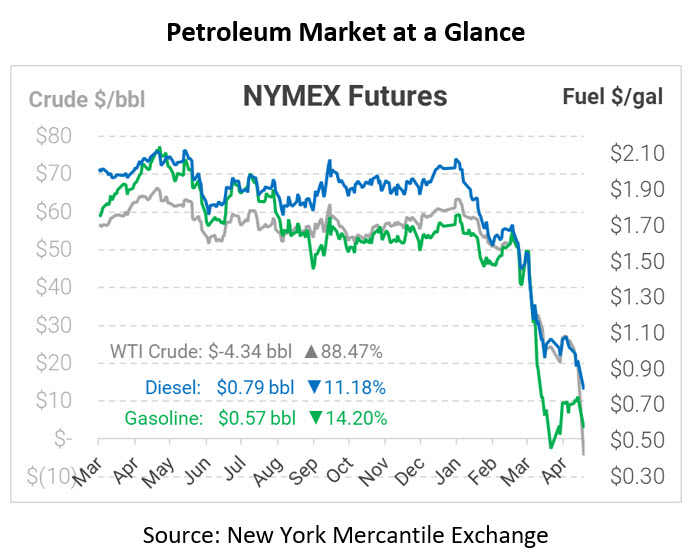

In early trading today, crude prices have recovered slightly from yesterday’s close, though it remains in the negative. Crude is currently trading at –$4.34, a gain of $33.29.

Fuel prices are down this morning, and unlike yesterday’s crude mayhem, this drop is affecting the entire forward curve, creating new lows for consumers considering fixed pricing. Diesel is trading at $0.7885, a loss of 9.9 cents. Gasoline is trading at $0.5743, a loss of 9.5 cents.

This article is part of Crude

Tagged: Cushing, futures contracts, Negative Prices, refiners, wti crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.