Why Do European Vaccines Impact Our Fuel Prices?

Yesterday brought yet another wave of selloffs thanks to a bearish API report, which we’ll discuss below. Over the past week, a major factor cited for the downturn has been delays in Europe’s vaccine rollout. With all the news circulating, an astute FUELSNews reader asked yesterday, “Why do vaccinations in Europe have an impact on North American fuel prices?” That question gets at the heart of global oil fundamentals, and is a great reminder of the complexity of oil flows.

Global oil markets are incredibly linked, and often oil can flow both ways. The BP’s Statistical Energy Review demonstrates the complex inner workings of global trade routes. As an example, the US imports a significant amount of crude oil from South America, but it also exports refined products to the country. Canada and the US exchange vast quantities of both crude oil and refined products. Specific to Europe, exports and imports may pass each other at sea, with US Gulf Coast exports being sent out while New York Harbor imports European crude to feed its regional refineries.

Source: BP

Overall, America imports XX MMbpd of oil and refined products, and exports XX MMbpd. It’s a never ending swirl of trading routes driven by pricing differentials and shipping costs. When Europe consumes less fuel, their prices fall. Middle Eastern suppliers, unable to earn top-dollar in Europe, send their oil to Asia instead. Because the US also exports to Asia, US exporters have to cut prices or keep the oil in the US. Efficient financial markets watch global trends closely, ensuring that falling oil demand (or rising demand, or interest rate changes, or a Tweet) show up in oil futures markets within seconds. Within a day, slow vaccine rollouts in Europe can cause local fuel prices across the US to fall.

Overall, America has imported 7.8 MMbpd of oil and refined products in 2021, and exported 7.6 MMbpd. It’s a never-ending swirl of trading routes driven by pricing differentials and shipping costs. When Europe consumes less fuel, their prices fall. Middle Eastern suppliers, unable to earn top-dollar in Europe, send their oil to Asia instead. Because the US also exports to Asia, US exporters have to cut prices or keep the oil in the US. Variations on that story ripples out in hundreds or thousands of different ways each day. Efficient financial markets watch global trends closely, ensuring that falling oil demand (or rising demand, or interest rate changes, or a Tweet) show up in oil futures markets within seconds. Within a day, slow vaccine rollouts in Europe can cause local fuel prices across the US to fall.

Today’s Oil Trends

Looking closer to home, the API released its weekly data, which showed a moderate crude build accompanied by a strong gasoline draw. The build was enough to give markets jitters, and prices plummeted following the release. The EIA’s more definitive data will come out later this morning, and traders will be looking either for proof that US fundamentals are still strong or proof that demand is really heading lower.

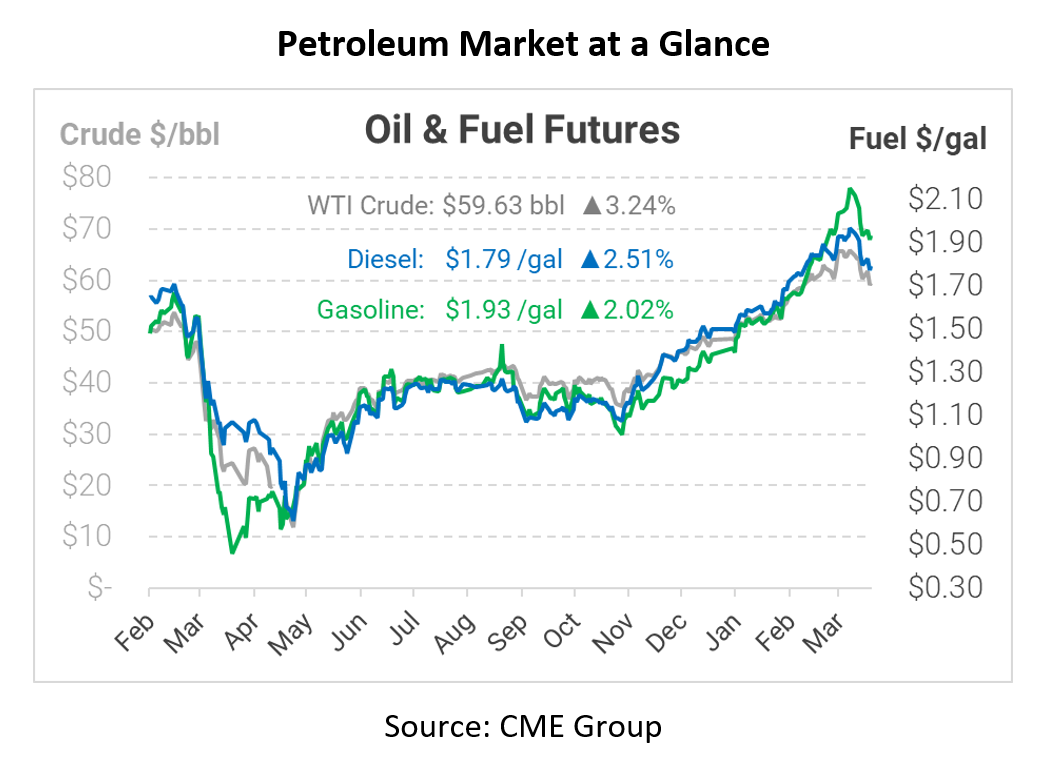

This morning, crude oil prices are recovering from yesterday’s selloff, with the bulls finally pushing back against bearish sentiment. WTI crude prices are currently $59.63, up $1.87 from yesterday’s closing price.

Fuel prices are riding the wave higher. Diesel is trading at $1.7928, up 4.4 cents. Gasoline prices are $1.9347, up 3.8 cents.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.