Who Is the Fed? Why Interest Rates Have a HUGE Impact on Fuel

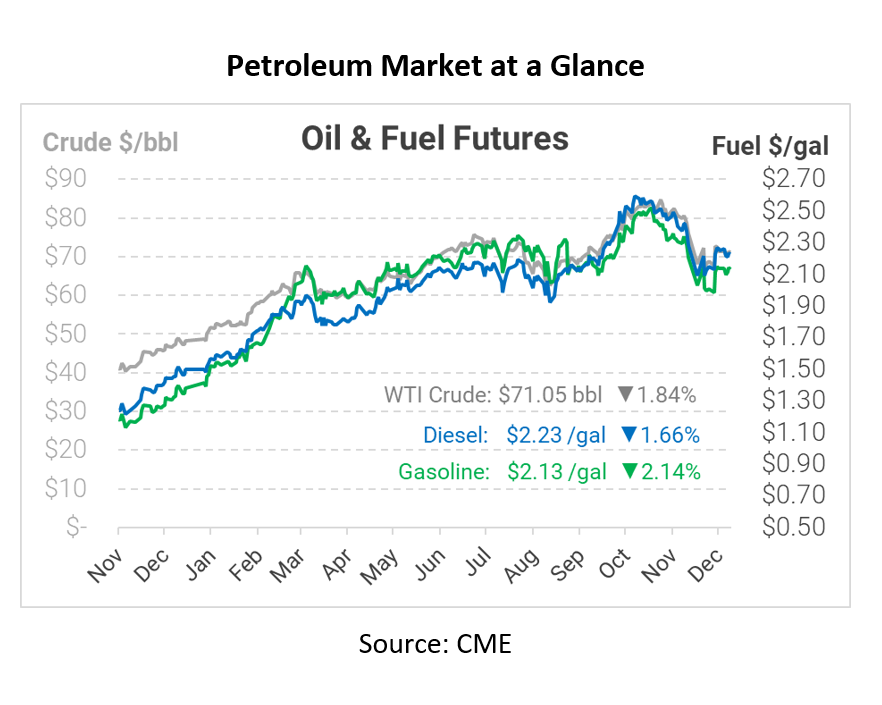

Oil prices are once again shrinking back, following other financial markets on a bearish turn. The Federal Reserve’s announcement about bond purchases and interest rate hikes initially gave markets a boost, since it provided clarity and certainty. However, over the long-haul, those actions tend to have a dampening affect on market prices, from oil to stocks.

Let’s step back for a second. The Federal Reserve is the US’s central banking system. They affect the economy by controlling how much America’s largest banks can borrow, and at what rate. Unlike the US Treasury, the Fed can’t simply print money but can do the next best thing – issuing debt. Over the past decade, they’ve bought trillions of dollars in bonds, thereby injecting cash into the economy and stimulating growth. Earlier this year, the Fed announced plans to slowly unwind its debt purchasing in 2022 and 2023, effectively removing stimulus from the economy and slowing growth.

With so much control over US economics, the Fed is an incredibly important actor to watch, and many investors take their cues from the Fed Chairman Jerome Powell. For months, Powell has brushed off inflation as “transitory”, meaning it would be short-lived. If that view were correct, then prices would start falling again, and the Fed wouldn’t need to change its approach. This week, however, Powell said he was retiring the term “transitory”, and announced a plan to more quickly end the Fed’s bond purchasing. That means less money in the US economy, slowing aggressive spending and rising costs.

Although this approach is generally seen as necessary, it won’t necessarily be painless. Markets have grown accustomed to the generous bond-buying regime and low interest rates, pushing stock markets to double digit growth for years. Higher interest rates will mean less spending and more savings, which is good for curbing inflation but could slow business growth.

Now, let’s tie that back to oil prices. Slower business growth and consumer spending means fewer Amazon packages delivered, fewer buildings constructed, and less trash hauled away. Consumers cutting back means fewer shopping trips and fewer miles driven. That slowdown will reduce demand, causing oil prices to fall. Of course, runaway inflation and rocketing prices would also eventually have the same affect, perhaps even worse. Market’s were glad for the certainty around how spending will slow down, but that doesn’t negate the fact that spending WILL slow down. Today, markets are feeling some of that pressure, causing prices to fall.

By the way, does this mean that oil prices will inevitably be lower in 2022? Not at all. Consumer spending will slow, but demand is still recovering. Fewer travel restrictions next year will still help raise oil-specific demand. At the same time, many analysts point to a severe underinvestment in oil supply, the other side of the equation. So with demand remaining steady and supplies facing material headwinds, it’s still quite possible that oil prices continue rising in 2022.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.