What Is the SPR? Exploring US Emergency Oil Supply

Analysis by Alan Apthorp

The Strategic Petroleum Reserve (SPR) has come up as an important subject since the beginning of the Russia-Ukraine invasion. Founded in 1982 with just over 250 million barrels, the reserve has been used throughout modern history to offset severe volatility and keep prices lower. Storage was maxed out in the 2008-2010 period; since then, the reserve has declined slowly. The past 3 months have seen the SPR fall faster than ever, so it’s worth digging deeper to understand where that oil came from, where it’s located, and how much is left.

Over the past 40 years, the SPR rose from a meager 250 million barrels to nearly 750 million barrels. Although held for strategic supply reasons, the SPR is also somewhat of an economic boon: across time, the average cost per barrel has been $29.70, and the average sale price has been $61.64. At current oil prices, the strategic reserve is worth nearly $61 billion – more than double the total cost of the oil in reserve. Of course, the storage and carrying costs add additional costs over time, but at a high level, the investment is valuable.

During times of distress, US presidents have tapped into the reserve. The reserve has been falling steadily since September 2021, since President Trump released oil for revenue purposes. Withdrawals have escalated, though, with 44 milion barrels withdrawn since February 25. That’s the fastest withdrawal rate in US history, at a time when prices have been near historical highs. Currently, the SPR has 537 million barrels remaining.

According to the Department of Energy: “The Strategic Petroleum Reserve is a U.S. Government complex of four sites with deep underground storage caverns created in salt domes along the Texas and Louisiana Gulf Coasts.” The reserve cannot be withdrawn all at once – at max capacity, up to 4 million barrels per day can be sold. Although President Biden authorized the release of 1 million barrels per day on March 31, the actual withdraw has been close to 600 thousand barrels per day.

Source: DOE

What does the future hold for the SPR? The IEA requires that all countries maintain at least 90 days of net imports as emergency fuel reserves. Because the US has heavy domestic production capabilities and only imports a small amount of its crude, the US has nearly 3 years of net imports in the SPR. That means that the US can continue withdrawing for quite a while before dropping below the IEA’s threshold.

SPR releases do not fix supply gaps; they are merely a short-term solution. Given that today’s high price environment is the result of structural supply losses and refinery closures, the SPR is just a band-aid for a broader industry challenge. It’s a welcome relief, but eventually SPR releases will not be enough to balance the market.

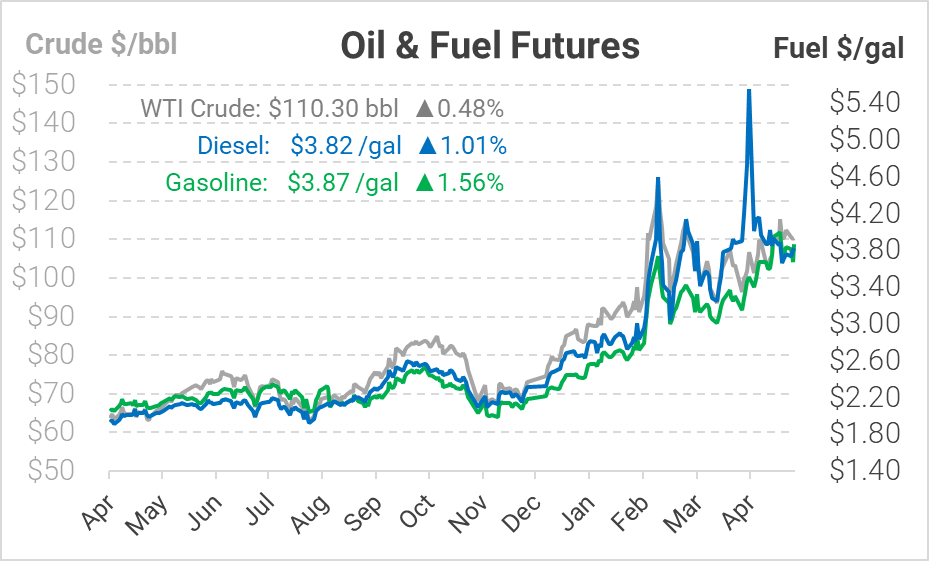

Petroleum Market at a Glance

Source: CME Group

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.