What Is It – Oil Inventories

Each week, traders eagerly awake 1030am EST on Wednesdays – when the EIA releases its weekly petroleum market report. The data contains details on many useful statistics, including supply, demand, refining trends, and imports/exports. One detail, however, stands out from the rest – how much of each product does the US have in inventory? The change in inventory levels can cause significant price moves. So what are these oil inventories the EIA covers, how is it calculated, and why does it matter for fuel buyers?

What Are Oil Inventories

Oil inventories consist of the many storage tanks in which oil can be stored. There are thousands of tanks around the US storing various products, including crude oil, gasoline, diesel, jet fuel, and more. Refiners have many storage tanks at their locations, to maintain a running inventory of crude oil and store finished products before shipment. Commercial hubs, which can have dozens or hundreds of these tanks clustered together, also store crude oil and refined fuels, so suppliers have a place to store their products.

How Are Inventories Measured?

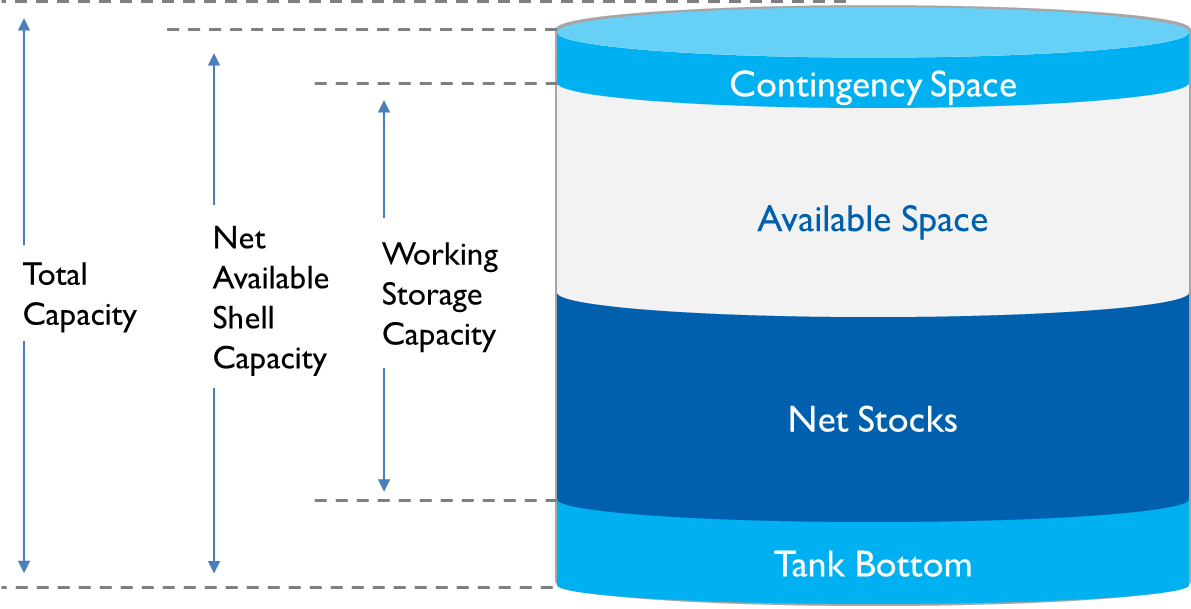

An oil tank is not simply filled 0-100% – storage managers must consider the different parts of the tank when calculating their inventory and available space.

Tank Bottom: A nonusable portion of the fuel that sits below the offtake pipe. The offtake pipe usually sits somewhat above the bottom, so all the sediment that finds its way into the storage tank does not get shipped out.

Net Stocks: The actual amount of fuel stored in the tank.

Available Space: The amount of space that remains empty but fillable.

Contingency Space: The area left at the top of the tank when the tank is filled to maximum safe capacity. Tanks cannot be filled to 100%; they must leave a small amount of space at the top to account for thermal expansion and emissions.

When talking about storage, the most useful number is the Working Storage Capacity, which tells how much fuel the tank can practically hold. The Working Storage Capacity excludes the bottom and contingency space, which are technically there but not practically useful. For a broader measure, including tank bottom and contingency space, the EIA also reports on the Net Available Shell Capacity. Finally, the Total Capacity includes unusable space at the very top of the tank, which is never filled with products.

How Much Storage Does the US Have?

In total, the US has the capacity to store a LOT of fuel. Across all fuel types, the US can store 2.2 billion barrels (94 billion gallons) of crude and refined products. Much of that is crude oil, with hydrocarbon gas liquids such as propane coming in second, followed by gasoline, diesel, and jet fuel. The EIA also reports on residual fuel oil, asphalt, and other fuels, though these comprise a smaller percentage of total storage capacity.

Source: EIA, March 2022

The US’s fuel supplies are spread out throughout the country, though crude and gasoline are concentrated heaviest in the Gulf Coast, where most of the US’s refining capacity lies. On the other hand, diesel stocks are most heavily concentrated in PADD 1 (East Coast). These numbers don’t include America’s Strategic Petroleum Reserve, which can hold another 713 million barrels of crude oil along the Gulf Coast.

Source: EIA, March 2022

How Are Inventory Stats Reported?

Two agencies report on US fuel inventories – the American Petroleum Institute and the EIA. Both groups use surveys to calculate how much fuel America has available; however, the API’s survey is voluntary, while the EIA’s report is mandatory. Because of this, the EIA’s data is considered more reliable and accurate. The API reports its data on Tuesday nights, ahead of the EIA’s Wednesday report. Find the latest EIA inventory data on their website.

Why Do Inventories Matter for Prices?

If you’ve ever taken an economics class, you know that prices are dictated by supply and demand. Inventories, then, are where those two numbers meet. When supply outpaces demand, it shows as rising inventories (seen during 2020’s COVID pandemic). When demand is more than supply, inventories fall. That’s why the market tracks inventories so closely – it tells the world whether there’s enough supply to keep up with demand.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.