What Is It – Gross/Net Gallons

Welcome to our continuing Wednesday FUELSNews series: “What Is It?” Each week, we’ll pick a fuel industry topic to explain, so you can learn more about the market and what drives it. Want to suggest a topic? Email the author, Alan Apthorp, at aapthorp@mansfieldoil.com. Thank you for the great suggestions so far – we’ll be adding topics on the RVO, renewable fuels, and different fuel terminal types in the near future. Keep the suggestions coming!

When is a gallon not a gallon? When the weather changes, you may get more or less fuel than you thought. If you’ve ever looked at a fuel invoice or a bill of lading, you may have seen two different volume quantities. For example, you might see a “gross gallons” number that says 7,500 gallons, while “net gallons” are only 7,450 gallons. Why is there a 50-gallon difference? It’s not a trick – it’s actually science. Today, we’ll cover the laws of thermodynamics in the fuel industry as we discuss gross and net gallons.

What Are Gross/Net Gallons?

The discrepancy between net and gross fuel purchasing stems from a law of nature called Thermal Expansion. When molecules are heated, they begin to move more quickly, causing the substance to expand. Conversely, when the molecules cool they move more slowly, and the substance contracts. It’s what happens when you bring a helium balloon into a cold room. As the molecules cool, they lose energy and condense – decreasing the volume inside the balloon and causing it to shrivel and sink.

In the U.S., 60°F is considered the temperature at which fuel is “normal” in weight, volume, and energy content; thus, it is the standard temperature used to measure true fuel volume. One gallon of fuel occupies 231 cubic inches of space at 60°F. Fuel expands as it exceeds 60° and contracts as it falls below 60°.

So to sum up:

Gross Gallons = The volume at local ambient temperatures

Net Gallons = The volume received, adjusted to assume the temperature is 60°F

Give Me a Real World Example

Okay, glad you asked. Let’s say 7,000 gallons of fuel is delivered to a location in Texas on a hot summer day. The fuel is pumped into a cool underground storage tank with an average temperature of 50 degrees. The fuel loses volume as it cools. In this situation, a full 7,000 gallons may have been delivered, but the location will have, as an estimate, 6,903 gallons once the fuel has cooled.

As a rough estimate, a 10°F change will cause fuel to contract or expand by 0.7%. So, a 30 degree change would yield approximately a 2.1% change in fuel volume, either up or down.

Which Number is “Right”?

Like many things in the fuel industry, the “right” number for your company can vary based on different factors.

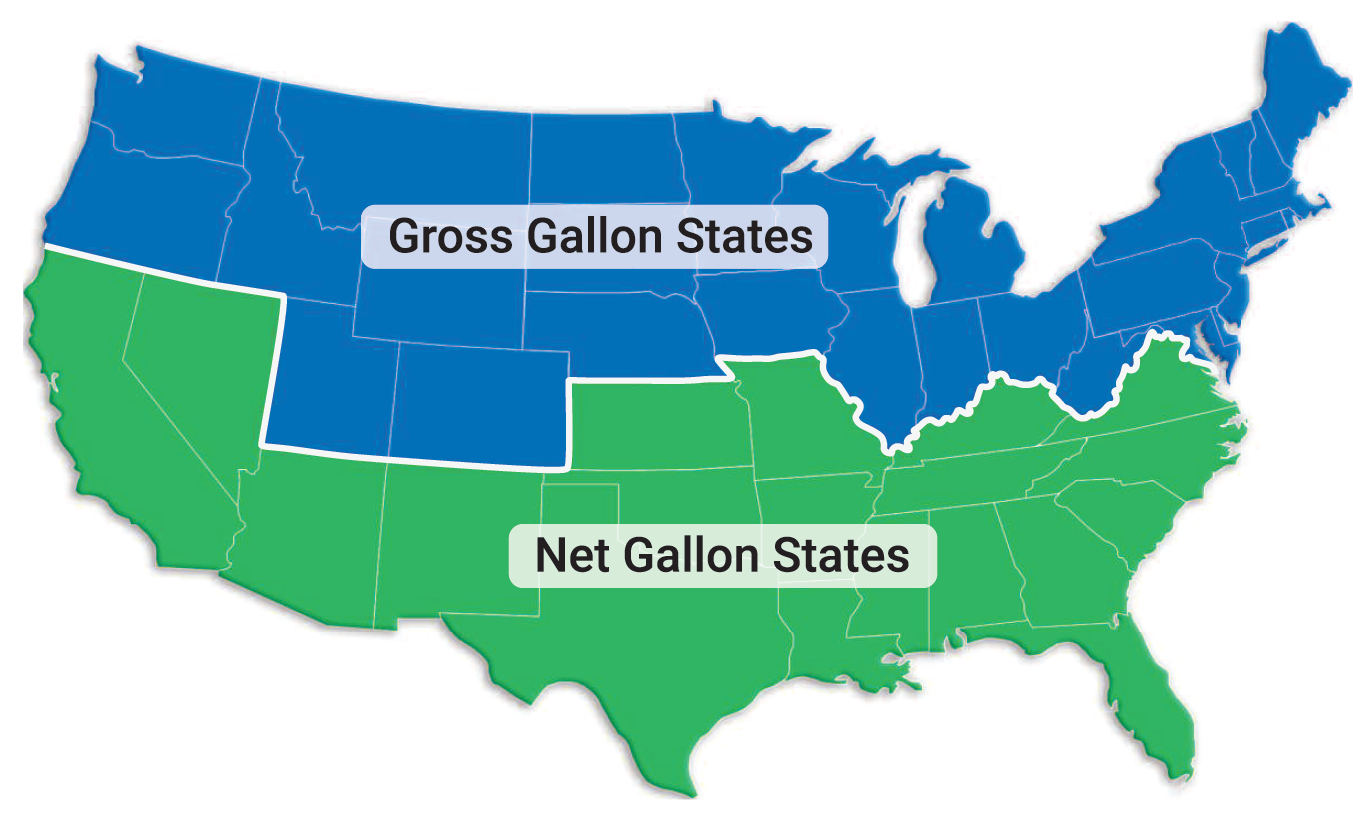

To avoid confusion, the petroleum industry generally divides the country in half, using gross gallons in the north and net gallons in the south. Between fuel wholesalers, nearly all bulk transactions are based on temperature-controlled net gallons, so fuel suppliers must consider that temperature risk when pricing customers. Your company’s tax manager likely encounters even more complexity – many states charge taxes based on the agreed volume, but some specify usage of gross or net gallon for taxation.

The division of the country works out to the benefit of customers. Northern states experience more cold weather, so the gross gallons are likely to be less than net gallons for a significant part of the year. That means northern customers are typically paying on the “lower” gallon amount. In the warm South, gross gallons are typically higher because of the heat, so consumers again get the lower number for most of the year. Not a bad deal!

This article is part of Daily Market News & Insights

Tagged: Gross/Net Gallons

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.