Weekly Price Review

Following a week of strong market sentiments driving prices higher, this week saw prices convulse each day, with large movements up and down despite relatively little overall movement. Crude prices opened this week at $49.85, and opened this morning at $48.95, a drop of $.90 (1.9%). After last week’s precipitous gains, this week’s loss brings a sigh of relief from consumers, though producers worry that prices have struggled to maintain a position above $50/bbl.

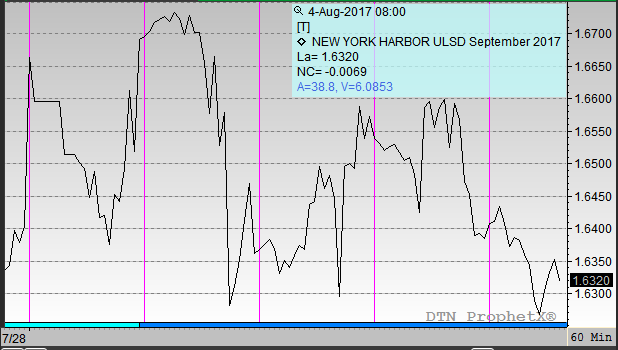

Refined products had an equally volatile week, with diesel prices fluctuating widely all week long. Prices normally tend to trend in a particular direction, but this week they seemed to just be oscillating back and forth without a clear direction. Diesel opened the week at $1.6500, and opened this morning at $1.6385, a loss of just $.0115 (-.69%).

Gasoline trended much more negatively, with four straight days of losses this week. Prices opened the week at $1.7017, and today opened at $1.6323, a significant loss of nearly 7 cents (-4.1%). This comes despite a gasoline inventory draw that surpassed market expectations and record high levels of gasoline demand, making the declines a perplexing trend. Of course, prices don’t always correlate to fundamentals – gasoline prices have seen significant strength lately, so this week may be explained simply as profit-taking by speculators who had bid up the market.

Prices opened the week on a strong note, falling throughout the day Monday before surging higher to end the trading session, but Tuesday’s bearish API report, including a surprise 1.5 MMbbl crude stock build, caused markets to lose roughly $1.80, settling at $49.16. Markets rallied a bit on Wednesday when the EIA contradicted the API’s report and showed a small stock draw, but markets only gained half of what they’d lost.

Markets were mostly neutral Thursday, as markets parsed through the EIA’s report and the overall build in all petroleum products despite crude and refined product draws. The market also has been wrestling with expectations for this weekend’s OPEC meeting in Abu Dubai, where OPEC members will be meeting to discuss compliance rates and what to do about Nigeria and Libya.

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.