Week in Review – October 28, 2022

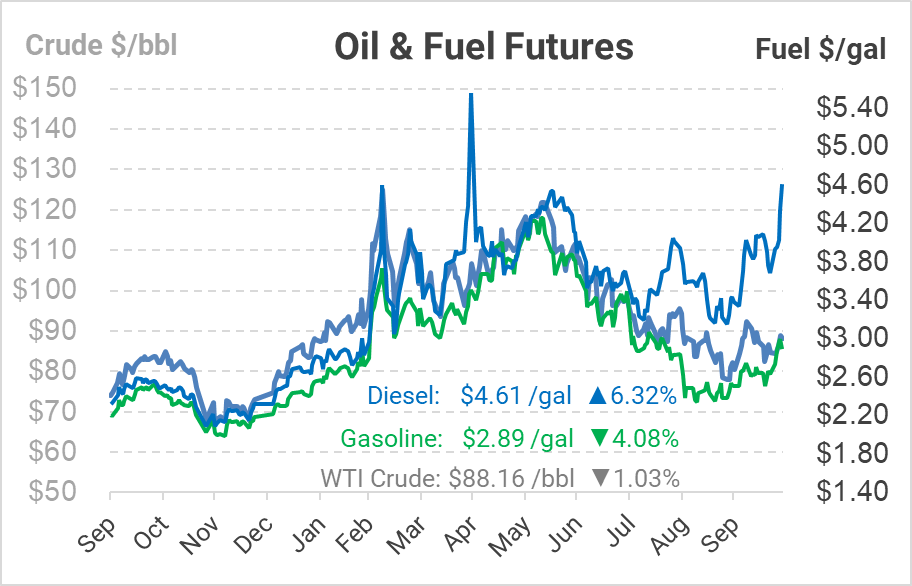

Last spring, diesel markets faced upheaval as inventories plummeted and supply shortages took hold along the East Coast. Over the summer, conditions cooled off a bit, allowing prices to fall back to more comfortable levels. The past two weeks have shown that fall and winter could face more intermittent supply challenges, along with higher prices.

Diesel prices are back up to $4.50 this week, the highest price since June. Over the past two weeks, diesel supply has fallen to just 25 days of supply, below the 35-40 days that are typically more comfortable for fuel markets. There simply isn’t enough refinery capacity in the world to produce enough diesel – especially during refinery turnaround season. Labor strikes taking 500 kbpd offline in France don’t help, either. Fuel is tight now, and winter will only bring higher demand. For these reasons, markets are bracing for supply crunches in the coming months.

Although gasoline has shown some physical tightness, especially on the West Coast (in September) and the East Coast (currently), diesel is the primary concern. The spread between diesel and gasoline briefly hit an all-time high of $1.70, surpassing the record $1.60 set months ago. Before 2022, the two products had never delinked by more than $1/gal at the NYMEX level. In their quest to keep up with diesel demand, refiners have had to create gasoline as a by-product, keeping stocks relatively well-supplied.

In December, the EU’s ban on Russian crude oil goes into effect. In February 2023, the EU will also ban refined product imports. Those deadlines mean that more US oil and fuels will need to be sent to the EU to fill the gap. More fuel going overseas means less at home – meaning even tighter supply over the winter. Expect tightening markets and higher prices – it’s going to be a bumpy ride.

Prices in Review

Crude oil prices are up this week, breaking out of the low-$80s range set earlier in the week. Crude oil opened the week at $85.24, rising to a high of $89 on Thursday. Prices fell back a bit on Friday, with an opening price of $88.67 – up $3.43 (+4%) for the week.

Diesel was clearly the break-out product, with steady gains throughout the week as the EIA showed low supplies. Opening at $3.8394 on Monday, each day saw steady gains, accelerating later in the week. On Friday, the product opened at $4.36, a gain of 52 cents (+13.6%).

Gasoline prices also saw some large increases this week, especially on Tuesday. Starting the week at $2.6472, gasoline prices surged above $2.90 on Tuesday, where it would spend most of the remainder of the week. Prices opened Friday at $2.9816, up 33.4 cents (+12.6%).

This article is part of Daily Market News & Insights

Tagged: Days of Supply, diesel, EU Embargo, gasoline, Supply crisis

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.