Week in Review – November 13, 2020

WTI crude finished the week higher on news of an effective coronavirus vaccine from Pfizer. In late trials, the vaccine is 90% effective at stopping the transmission of the coronavirus. Traders read the news as a return to normalcy and a sign of future increased demand for fuel.

Although the future is hopeful, near-term health outlooks seem bleak. A recent surge in coronavirus infection around the world has caused a second round of lockdowns and restrictions to be enacted in many US states and European countries. There is rising fear of a slowing recovery and decreased demand for fuel as we enter the already low demand winter season.

In OPEC news this week, Saudi Arabia, Iraq, and Algeria have each separately reiterated their commitment to supply cuts and a balanced market. Algerian representatives stated that OPEC could cut supply further at their meeting at the end of the month if necessary. Traders are hoping for action from OPEC as US supply recovers from hurricane activity and as Libya increases supply to the market.

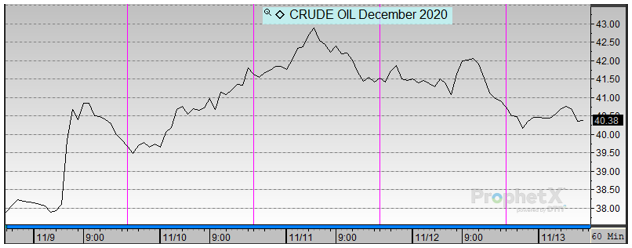

Prices in Review

WTI Crude opened the week at $37.34. It rose to mid-week after which it gave back some of those earlier gains to close the week. Crude opened Friday at $40.94, an increase of $3.60 (9.6%).

Diesel opened the week at $1.1498. It followed crude throughout the week to close higher. Diesel opened Friday at $1.2269 a gain of 7.7 cents (6.7%).

Gasoline opened the week at $1.0905. It also peaked mid-week to close the week higher. Gasoline opened Friday at $1.1503, a gain of 6.0 cents (5.5%).

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.