Week in Review – November 12, 2021

Monday brought along headlines that OPEC+ declined the calls for help from the United States. The U.S. reached out to ask for assistance to curb rising prices, but to no surprise OPEC+ remained strong in their current decision for output. With oil prices hitting over $80 per barrel, consumers are demanding answers – and the Biden administration is under immense pressure to combat rising prices, with the possibility of tapping into the strategic reserves growing stronger. The last time a major tap into the strategic reserves was initiated was in 2011 when tensions with Libya reached a critical level. The other two major events during which the reserves were used were Hurricane Katrina in 2005 and Operation Desert Storm in 1991.

Knowing how prices are affected when strategic reserve petroleum is released is also important to understanding the market as a whole. The strategic reserves were created in response to the Arab Oil Embargo of 1973/1974 and were built to hold up to 1 billion barrels of petroleum. While many emergency conditions grant the president the power to release oil from the reserves, it must be done meticulously. Today, if the Biden administration were to release 30 million barrels from the reserves, it would only equate to increasing global demand by 82,000 barrels per day (bpd) to the market for one year. The insignificance of a release of 30-60 million barrels shows that regardless of a possible release issued by the government, the price impact would be minimal in relative comparison to an increase by OPEC.

Lasty, to add to the fears of growing prices comes inflation. Yesterday, data was released showing inflation rose 6.2%. This is the highest inflation level in over 30 years, causing a higher U.S. dollar while driving oil prices down. The President has asked the National Economic Council to help reduce energy costs and has also asked the Federal Trade Commission to help reverse inflation in the energy sector using anti-market manipulation techniques. One thing is for certain, the energy price crisis and inflation are far from over.

This Week in Energy Prices

Today crude opened at a price of $81.21, a change of $0.08 from Monday’s opening price of $81.13. Throughout the week crude increased steadily until reaching the mid-week peak on Wednesday. After this prices began to pull back.

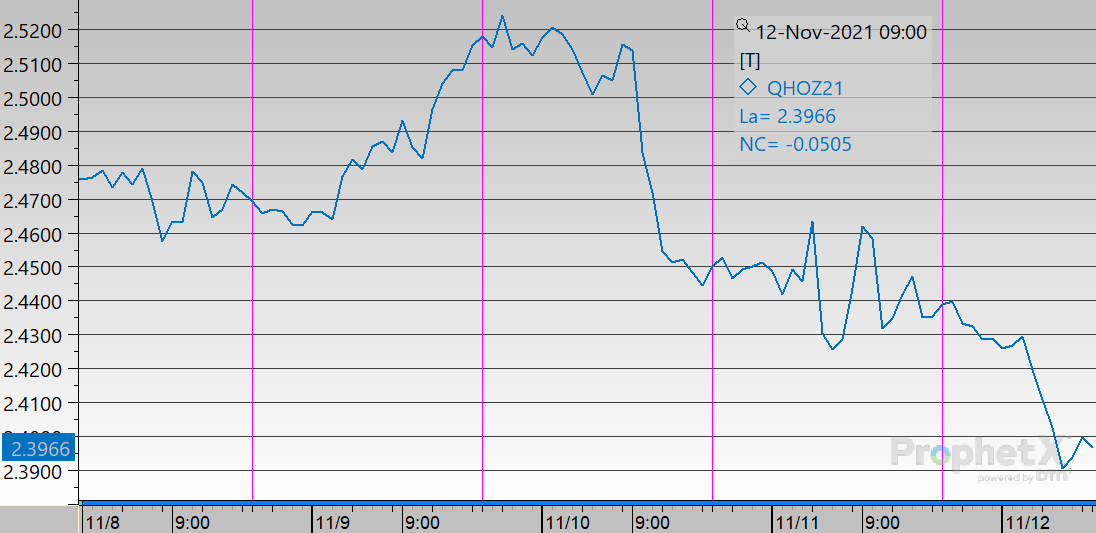

Today diesel opened at $2.4340, a change of $0.0093 from Monday’s opening price of $2.4433. Diesel followed the trends of crude this week with Wednesday being the peak price point. Prices fell back Thursday and Friday where this morning’s opening price was the lowest of the week.

Today gasoline opened at a price of $2.3124, a change of $0.0034 from Monday’s opening price of $2.3090. Gasoline prices increased throughout the week before pulling back Thursday and Friday.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.