Week in Review – March 24, 2023

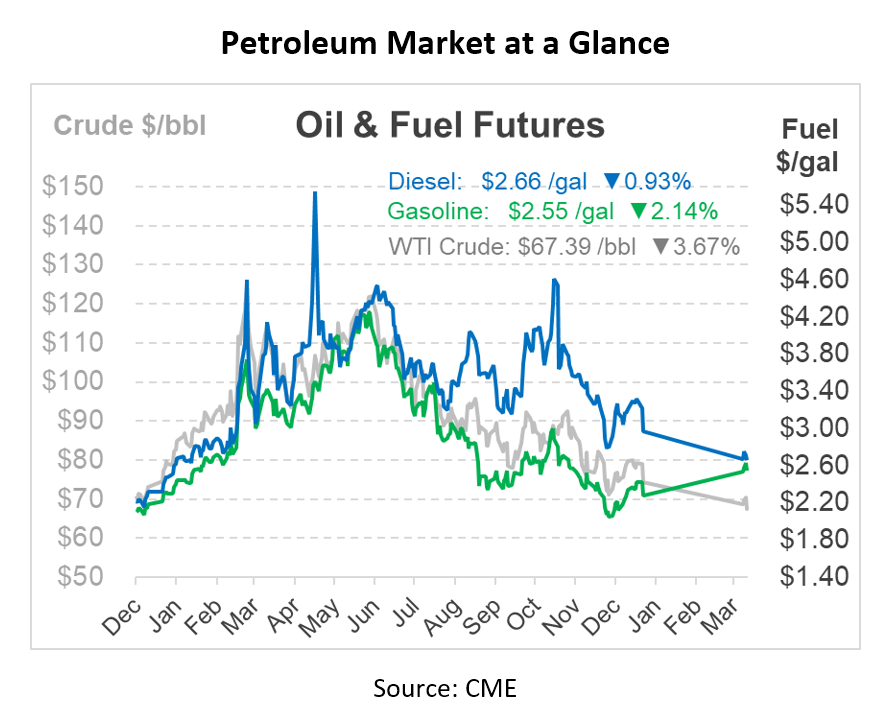

Crude oil prices are facing downward pressure this morning, dropping over $2.50/bbl. This decline is likely due to concerns surrounding Deutsche Bank, which may be the next institution to experience bottlenecks. The ongoing apprehension of contagion within the banking sector adds to the uncertainty affecting oil prices. The current state of lower equities and yields, along with a stronger US dollar, also contributes to the downward pressure on oil prices.

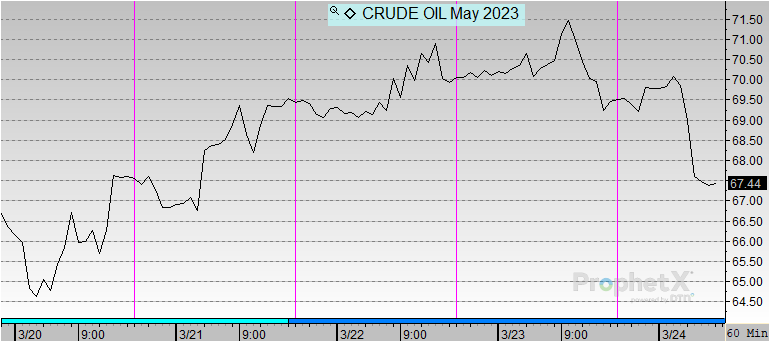

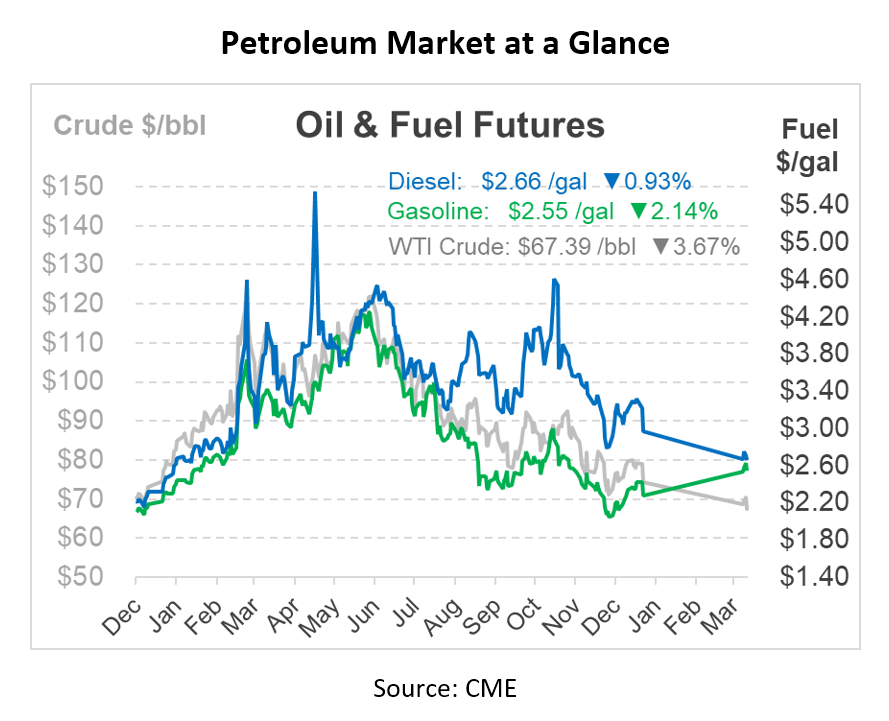

Front crude futures seem poised to end the week on a lower note as the threat of contagion persists, creating headwinds throughout the market. In the past five days, prices have oscillated within a $3/bbl range, gradually rising from Monday’s lows despite a downturn yesterday. On Thursday, crude futures experienced a decrease of around 1% in dollar terms, with Brent dropping $0.78/bbl to $75.51 and WTI falling $0.94 to $69.96. This downturn negated the slight gains observed on Wednesday, which occurred despite the FOMC’s announcement of a 0.25% rate increase.

Compounding the challenges faced by the oil market, US Energy Secretary Jennifer Granholm mentioned yesterday that replenishing the Strategic Petroleum Reserve (SPR) at the target price would prove “difficult.” Granholm’s acknowledgment that the U.S. may struggle to capitalize on the current low oil prices due to the mandated sale continuing through June and maintenance issues at two SPR sites could lead to uncertainty and volatility in the market. The Biden administration’s intention to refill the reserve when oil prices dipped below $70/bbl, in response to last year’s 180-million-bbl sale aimed at alleviating fuel price increases from the Ukraine war, may now face delays.

Prices in Review

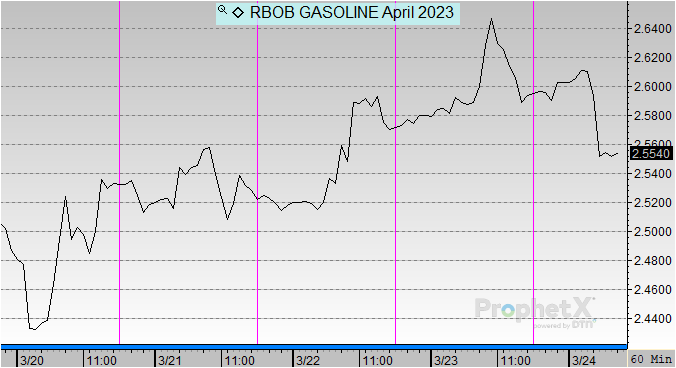

Refined product futures mirrored the downward trend in crude, as the NYMEX May RBOB contract fell by 6.8 cents to $2.4990 per gallon. Meanwhile, the front-month April RBOB futures dropped by 7 cents to $2.5360 per gallon.

Crude opened the week at $66.62 after a sharp decline since the banking crisis. Throughout the week, crude held steady gains and opened at $69.51 this morning, accounting for a bump of $2.89 or 4.34%.

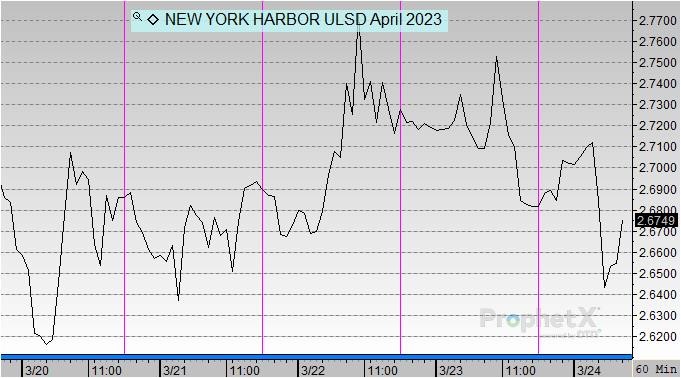

Diesel also saw some gains this week, opening on Monday at $2.675 before hitting a high of $2.7255 on Wednesday. Diesel opened this morning at $2.6847, a change of less than one cent or 0.3626%.

Gasoline trailed closely with diesel this week with minimal gains. Gasoline opened the week at $2.5015 before hitting its highest on Thursday at $2.6466. This morning, gasoline opened at $2.5901, accounting for an increase of nine cents or 3.54%.

This article is part of Daily Market News & Insights

Tagged: crude oil, Deutsche Bank, NYMEX, prices, Refined product

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.