Week in Review – February 26, 2021

Fuel prices were a roller coaster this week, soaring and sinking and soaring again. The market was turned upside down last week by freezing weather in Texas, one of America’s most important hubs for production and refining. Crude fields stopped pumping, and refineries shut off their operations quickly, making restarts difficult. At the same time, consumers and industrial companies stayed off the road, lowering fuel demand.

The EIA’s weekly report, released on Wednesday, told the story of a chaotic week. Gasoline demand fell by over 1 million barrels per day (MMbpd), while diesel saw 0.5 MMbpd drops. Jet fuel demand also suffered. Upstream, production fell by 1.1 MMbpd, and refinery utilization fell from over 80% to just 68.6%. As demand resumed and supply remained tight, fuel prices inched higher, setting new 18-month highs on Wednesday and Thursday.

In addition to oil supply/demand chaos, financial markets also had a rocky week. Fears of inflation spooked bond markets, causing market rates to rise and pushing the US dollar higher. The rising dollar caused headwinds for oil prices, given their inverse relationship. Although the Fed Chair Jerome Powell tried to reassure markets that the Fed would keep interest rates low, investors weren’t convinced. Bond rates climbed this week, increasing yields and giving traders an alternative to high-risk assets like tech stocks and commodities.

Looking ahead, demand appears to be back near pre-storm levels, but refineries continue working on their restarts. That dynamics should keep prices elevated for the next couple weeks. On the other hand, OPEC+ is meeting next week to discuss their production quotas, and the general expectation is a moderate production increase. More OPEC+ production would send crude oil prices lower, dragging fuel prices with it.

Several banks this week posted forecasts that Brent crude could rise to $70/bbl or more, with Goldman Sachs expecting $75/bbl oil in Q3 2020. Such gains would be another $5-10/bbl above current prices, suggesting a 12-25 cent gain for fuel prices.

Prices in Review

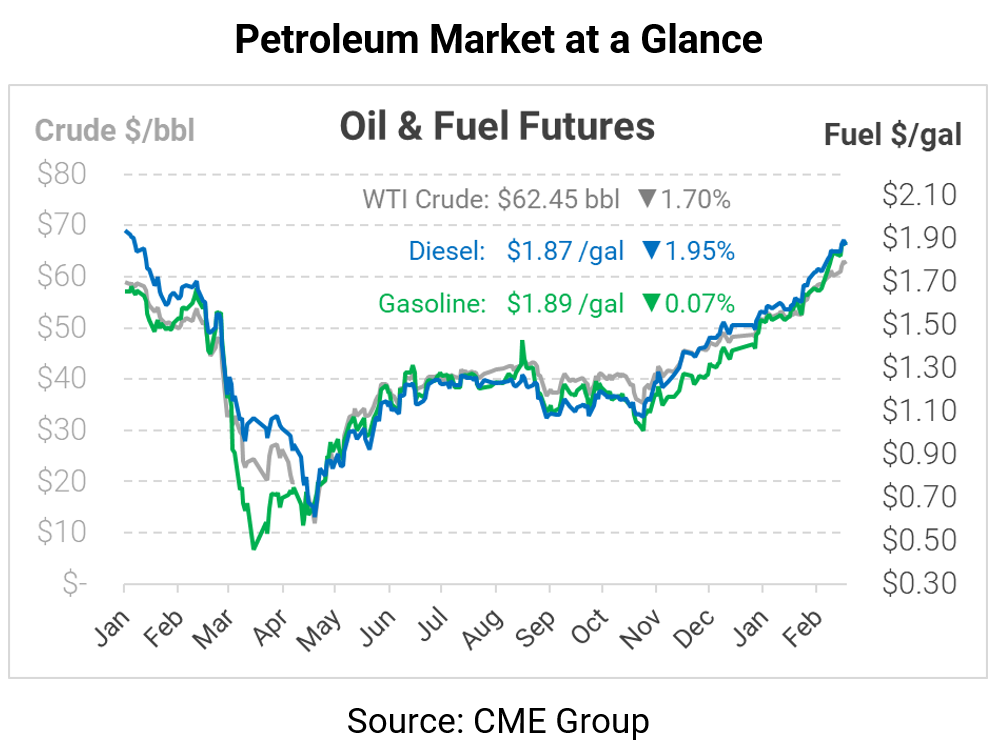

Crude oil prices opened the week at $58.88, suppressed by weak demand the week prior. Prices climbed throughout the week, supported by refineries knocked out by the winter storm. This morning, crude opened at $63.46, a gain of $4.58 (+7.8%).

Diesel also saw solid gains this week, climbing to new multi-year highs as crude recovered. Diesel prices opened Monday at $1.8141, climbing higher nearly every day. Diesel opened Friday at $1.9095, up 9.5 cents (+5.3%).

Gasoline prices followed a path similar to that of crude and diesel – opening low, and climbing through the week. Opening at $1.7873, gasoline climbed to open at $1.8950, a gain of 10.8 cents (+6%).

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.