Week in Review – February 25, 2022

Major headlines this week included pre-invasion calls from Biden to meet with Putin about diplomacy, supply concerns that are rampant throughout the world, and the Russian invasion of Ukraine. First, earlier this week Biden again tried to urge Putin to choose diplomacy over invasion. The meeting was only going to happen if Putin did not invade, so this idea of meeting in person did not last long after the Russian leader decided to move forward with his Ukrainian invasion. With the French brokering meetings between Russia and the rest of the world, everyone was eager to see a potential Biden-Putin summit, but that did not happen.

With rising geopolitical tensions accompany an already volatile energy market, supply concerns are not surprising during these times. This week, specifically on Tuesday, oil was extremely volatile. A major refinery in Louisiana experienced an explosion on Monday, injuring several workers and knocking out the plant’s diesel-producing hydrocracker. The refinery, capable of producing over half a million barrels (21 million gallons) of fuel each day, has not reported how the explosion and fire will impact production, though market analysts expect that diesel production may drop through March. Bloomberg reports that currently, 10% of Gulf Coast refining capacity is offline for repairs, so markets may have already priced in the effects of limited local supply. Long-term effects of the explosions are still unknown, but Mansfield will continue to monitor the situation going forward.

Lastly, this week we talked more about most significant news of the week in that Russia has finally followed through with their plan to invade Ukraine. With hundreds of people already killed on both sides through small battles in the country, it is still unknown how far Putin is willing to take this. Yesterday during the news of invasion, WTI crude briefly surpassed $100/bbl. Fuel prices were up 15-20 cents per gallon. It’s rare to see prices change by such large amounts overnight; only during the most severe shocks – COVID, Saudi Arabia bombings, 2008 recession, 9/11 – have we experienced such historic moves. The next move for this event is sanctions that the Biden administration has handed down. As the second-largest global producer, Russia produces 10% of the world’s oil. Depending on how sanctions are worded, Russia may be cut off from international markets (like Iran and Venezuela were) or simply cut from US and European trade. The former would be devastating for global oil prices, while the latter would cause intense short-term pain but ultimately could lead to re-routing oil flows. Time will tell how affective these sanctions will be, or if this situation will continue to grow more intense.

Prices in Review

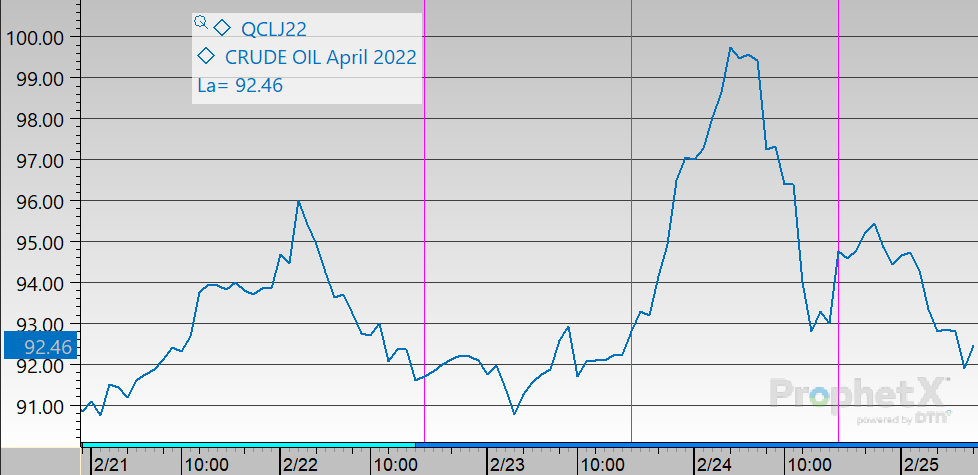

WTI Crude opened the week at $9175. Prices were volatile and rose steeply to the highest price since 2014 on Thursday during the Russian invasion of Ukraine. Crude opened Friday at $93.32, an increase of $1.57 the beginning of the week.

Diesel opened the week at $2.8013 Diesel followed the same trends as crude before opening Friday at $2.9081, an increase of $0.1068 from the start of the week.

Gasoline opened the week at $2.6915. Prices followed similar volatile patterns to crude and diesel, before hitting highs on Thursday. Gasoline opened on Friday at $2.7728, an increase of $0.0813 throughout the week.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.