Week in Review – December 3, 2021

This week we started out by reviewing what happened during the Thanksgiving break. While there were a few new things to shake up the market, none were bigger than the Omicron variant, strategic petroleum reserve release, and inventory news. Also making headlines was information about the Transmountain Pipeline outage. The Transmountain Pipeline, which ships crude oil from Canada down to Washington and Oregon refineries, has been temporary offline due to flooding. In the meantime, refineries are forced to rely on barge and rail shipments to keep up with fuel demand during one of the heaviest travel periods of the year.

We also dove into the idea of buying into the dip, and why Omicron may be an opportunity. Omicron is a big unknown right now, so the market is reacting to a worst-case scenario. The CEO of Moderna hinted that the virus may be more vaccine-resistant than other strains, though he also noted that plans were underway to produce and distribute a booster targeting the new variant. On the flip side, the BioNTech founder said it’s unlikely to cause severe illness in vaccinated individuals. What does all this mean for fuel prices? It’s possible that prices could dip somewhat in the short-term as some countries introduce lockdown measures, but those should prove temporary. Moreover, OPEC+ producers have struggled to get production as high as it is, so they may not be able to follow through on the recent quota increase.

Lastly, we reviewed what was happening this week regarding OPEC+. The group began its two-day meeting on Wednesday to review oil market conditions, deciding how they want to proceed in the future. After cutting over 10 million barrels per day (MMbpd) at the peak of the pandemic, OPEC has been rubberstamping a 0.4 MMbpd supply increase each month, with 3.8 MMbpd left to go. After deliberation, OPEC+ decided that they would add another 400,000 bpd in January, regardless of fears from the United States strategic crude releases or the new variant that could lead to a price rout.

Prices in Review

WTI Crude opened the week at $69.23. Prices rose slightly on Tuesday before falling back down. Crude opened Friday at $67.50, a decrease of $1.73 from Monday.

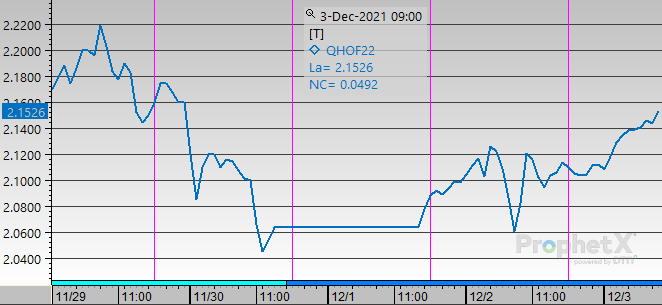

Diesel opened the week at $2.0945. Diesel fell throughout the week before increasing Thursday and Friday. It opened Friday at $2.1109, an increase of $0.0164 from Monday.

Gasoline opened the week at $2.0785. Prices steadily decreased throughout the week until going back up slightly on Friday. Gasoline opened Friday at $1.9835, down $0.095 from Monday’s opening price.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.