Week in Review – December 10, 2021

On Monday, news started to hit the market that there could possibly be some positives coming with the Omicron variant that were not previously thought of. The main news was that only mild symptoms are being seen around the world. This comes after many health officials suggested that this could be a more extreme version of COVID-19, so this has sparked positivity among much of the world’s top health researchers. In South Africa, health officials told top U.S. doctors that “it does not look like there’s a great degree of severity.” Scientists believe South Africa is a credible region to start in given the amount of Omicron variant infected individuals. Altogether, this could be a huge break for the market as some positivity creeps its way in for a change.

On Tuesday, the EPA finally released its 2020-2022 renewable fuel requirements. This started debates from critics on both sides that surely will not end for the foreseeable future. The EPA set the 2020 Renewable Volume Obligation (RVO) to 17.13 billion gallons, undoing the previously required 20.09 billion gallons set before the pandemic. They also slashed the 2021 requirement to 18.5 billion gallons, while increasing 2022 to 20.8 billion gallons. In addition, the proposed ruling would reject 65 applications for small refinery exemptions, in line with a federal court ruling earlier this year which made exemptions harder to receive.

Lastly, yesterday we learned about the three bearish trends that push prices down in the market. These trends would be new variants such as Omicron, China’s worsening economic growth, and EIA reports. England, Denmark, and China imposed new restrictions to curb the spread of Omicron. Some countries are facing rising case rates, causing fear that more restrictions could come in the future. Adding to bearish sentiment, two Chinese real estate companies went through a rating downgrade, indicating China’s decaying economic growth. One of the companies, Evergrande, has already been in the news this year due to default fears. Lastly, the EIA released their weekly report Wednesday, which also showed some bearish numbers. Although the market expected a solid draw from crude inventories, they fell by just 0.2 million barrels.

This Week in Energy Prices

Today crude opened at a price of $70.68, a change of $3.66 from Monday’s opening price of $67.02. Throughout the week crude increased until reaching the mid-week peak on Thursday before dropping down.

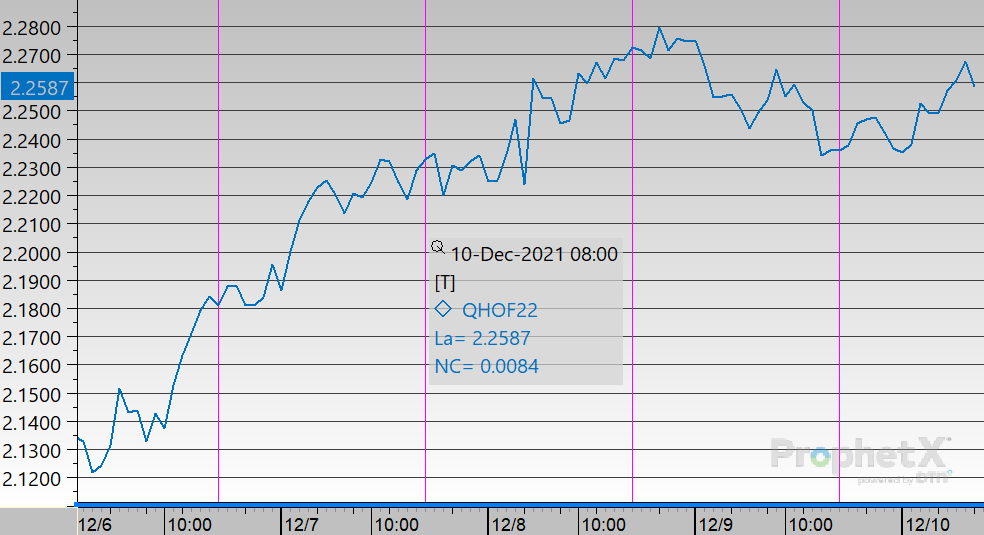

Today diesel opened at $2.2409, a change of $0.1249 from Monday’s opening price of $2.1160. Diesel followed the trends of crude this week with much volatility. Prices increased until Thursday before dropping back down during the day.

Today gasoline opened at a price of $2.1163, a change of $0.1513 from Monday’s opening price of $1.9650. Gasoline prices increased throughout the week before pulling back Thursday.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.