Week in Review – August 28, 2020

This week followed a classic “buy the rumor, sell the fact” pattern, with fuel markets spiking ahead of Hurricane Laura before shedding gains later in the week. From Monday’s opening level to Friday’s, WTI Crude finished the week slightly higher. The effects of the twin storms hitting the Gulf Coast were priced in early in the week with rising prices on Monday and Tuesday. After the storms made landfall with minimal impacts on the energy infrastructure, prices fell to pre-storm levels and lower for products to close the week.

Progress on the Phase One trade deal was announced on Wednesday, and the US and China made commitments to move forward with improved trade relations. On the same day, the EIA reported a draw for crude in line with expectations, a larger-than-expected decrease for gasoline, but a surprise build for diesel.

The bullish news this week was tempered by fears of slowing demand caused by a resurgence of coronavirus cases in Europe and Asia. Spain, France, and South Korea are all seeing a recent spike in cases, especially among younger people. Hope for a cure continues to moderate bearish sentiments, and US President Trump again reiterated this week that a vaccine is on track for deployment before the end of the year.

Prices in Review

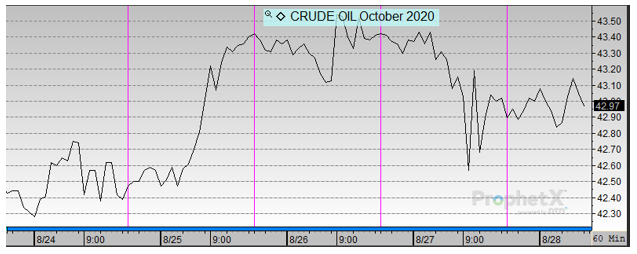

WTI Crude opened the week at $42.48. It followed a choppy path to end the week slightly higher. Crude opened Friday at $42.98 a gain of 50 cents (1.2%).

Diesel opened the week at $1.2133. It started the week higher than crude, but generally followed crude throughout the week. The surprise draw reported by the EIA caused prices to sink in the middle of the week, and Hurricane Laura’s limited effects led to a sharp selloff on Thursday. Diesel opened Friday at $1.2108, a loss of 0.3 cents (-0.2%).

Gasoline opened the week at $1.2943. Like diesel, gasoline saw a large midweek bounce – soaring 6 cents on Tuesday before closing lower – as Hurricane Laura threatened refining capacity. Although gasoline inventories are now just 5% above the five-year average, gasoline could not escape the Thursday petroleum complex selloff. Gasoline opened Friday at $1.2786, a loss of 1.6 cents (-1.2%).

This article is part of Daily Market News & Insights

Tagged: coronavirus, crude, diesel, eia, gasoline, hurricane laura, refining

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.