Week in Review

I’m including last week’s review again with an update, because it’s a helpful way of summarizing the recent price changes:

Many of the declines lately have shown a similar pattern – breech a key psychological barrier, then quickly fall to the next:

- October 17 – Prices drop below $70. Fell to $65 two weeks later.

- Nov 1 – Prices drop below $65. Fell to $60 a week later.

- Nov 12 – prices drop below $60. Fell to $55 the next day.

- Nov 20 – prices drop below $55. Fell to $50 in two days.

- Dec 17 – prices drop below $50. Fall to $46 the next day, $45 two days later.

Crude trading at $50/bbl is an arbitrary number – the difference between $49.99 and $50.01 is virtually nothing, but there’s psychological value. Many automated trading strategies use round numbers for simplicity – $45, $50, $55. When those levels are breached, they trigger significant market moves despite having no true fundamental meaning. Since the $60/bbl level was breached in early November, purely technical plays have been driving the market lower.

Why does that matter? Very few analysts, agencies, or banks agree that $45/bbl oil is justified. While demand prospects are gloomy, inventories are far lower than the last time oil was at $45. OPEC has been moderating supply and appears to be on track to do the same in 2019. If it’s true that the recent bear market was caused by tech and not truth, then consumers should expect prices to rebound in the coming months back to at least $60/bbl crude (diesel ~$2.10).

*Dec 28 Update*

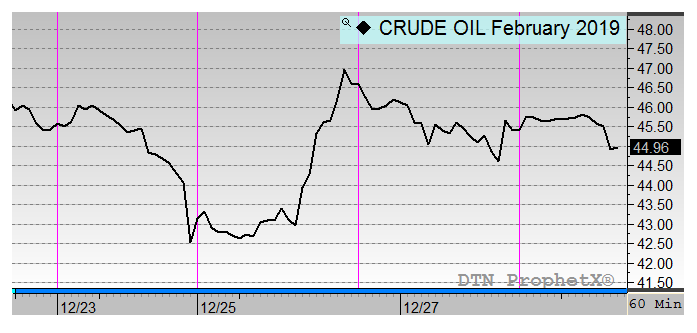

This week, prices breached $45, but markets never made it all the way to $40. Why was this latest drop different? According to famed oil economist Phil Verleger, the Christmas Eve sell-off was caused by oil producers hedging their 2019 output, not by speculative training.

US producers have only locked in oil prices on 24% of their production, well below the 34% hedged going into 2018. With prices rising throughout the year, producers didn’t feel the need to hedge – they preferred timing the market to let prices keep rising. Now that prices are $20/bbl below the October peak, they’re rushing to lock in rates before prices fall below their break-even rate.

Producers hedge their production by “selling” futures now, which is functionally no different than speculators selling suddenly. On Christmas Eve, the buyers were away; without demand, the excessive supply of oil contracts pushed prices lower. That’s why we saw such a large rally after Christmas – traders coming back from the holidays quickly took advantage of the bargain and bought the price back up.

Christmas Eve’s dip and rally does not necessarily break the trend of prices falling quickly after breaching psychological thresholds; rather, it was a market fluke that was quickly corrected.

Prices in Review

Crude oil opened the week on Monday at $45.22, slipping quickly to $42.50 as hedgers locked in their 2019 production. Off Tuesday for the holiday, traders returned on Wednesday and quickly bid prices back up as high as $47 before dipping lower. Prices traded fairly evenly for the rest of the week, and Friday’s opening price of $45.44 represents virtually no change from the beginning of the week.

Diesel prices also took a hefty blow on Monday before rocketing higher. Diesel opened at $1.73, and fell to $1.66 by the end of the day – a seven cent loss. But Wednesday saw prices shoot right back to their starting point, closing at $1.73 once again. Since then, diesel has been a bit more bearish than crude, and Friday’s opening price of $1.6983 represents a 3.6 cent (-2.1%) decline.

Gasoline was not exempt from the sell-off. Already one of the weaker products in the oil complex, gas prices fell from Monday’s opening price of $1.3115 down to just $1.24. The next day, though, prices shot to $1.33, above the week’s opening price. This morning the product opened at $1.3243, eking out some small gains for the week.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.