Week in Review

It’s been a bumpy week, with oil markets being shaken by international events as much as fundamental data. Production shutdowns in Kurdistan, which is currently in contention with the Iraqi federal government, have helped boost markets, though some of the risk had already been priced into the market. On the fundamental side, a steep crude stock draw of 5.7 million barrels gave markets a small boost, though the draws were driven by disruptions from Hurricane Nate rather than underlying concerns. OPEC continued signaling that a production cut extension in 2018 is on the table, and many countries have supported the idea.

Crude markets have been up and back down this week, opening today just a penny below Monday’s opening price. Over the past 7 weeks, crude markets have gained $6.50, with this week marking just the second week of falling prices. Of course, before that, prices gave up $5.74 in August and early September. Markets are continuing their seesaw, waiting for a larger market mover to shake it up. Markets opened this morning at $51.42, towards the higher end of the $45-52 range markets have traded in all year.

Unlike crude, diesel prices are down 2 cents this week, opening today at $1.7767 today, though so far the general trend is towards higher prices today. Markets opened the week at $1.7975, just shy of the $1.80 price level they’ve been hovering around. It was just one month ago today that prices surpassed $1.80 for the first time in years, and now it’s become the norm. Many believe diesel prices are about as high as they can go for now, and that a correction may be in order.

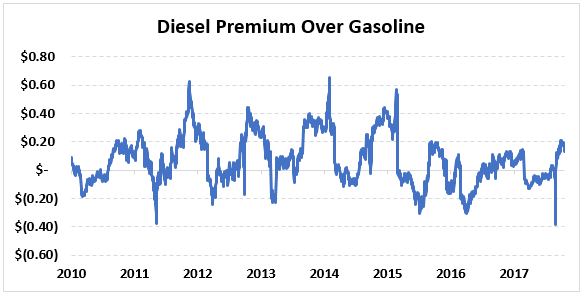

Diesel prices often trend 20-40 cents or higher above gasoline prices during the fall as gasoline demand falls and heating oil needs pick up. In 2015 and 2016, that range stayed mainly between 10-20 cents as overall prices plummeted and crude flooded the markets. Now that markets are beginning to sure up, it’s possible that diesel may once again reign supreme. Prices are already at the top of that 20 cent range, and could move even higher as winter heating oil demand takes hold.

Surprisingly, gasoline has gained 2.4 cents this week, extending their gains from the past two weeks. Prices have oscillated significantly over the past few weeks, with prices quickly shooting up and falling back down. With that said, prices are down slightly this morning, as the market has been fairly quiet this morning. While markets have made some gains over the past couple weeks, overall markets are expecting gasoline to remain low this winter as inventories remain sufficient to meet demand.

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.