Week in Review

After setting the record for longest consecutive losing streak for NYMEX WTI Contracts, crude turned around and began to rise higher, though not before a massive $4 price move on Monday. Since then, markets have been slowly recovering, trending slightly higher but not overcoming Monday’s huge drop off.

The recovery has helped push OPEC to reconsidering their production increases. Saudi Arabia committed this week to cut their December production by 500 kbpd in December to help bring markets closer to balance. The long decline was prompted by Trump’s announcement of several countries receiving Iran sanction waivers, functionally flooding the market with unexpected Iranian product. The waivers are set to be good for six-months, beyond that, markets could either tighten significantly or continue to be awash in product.

Prices in Review

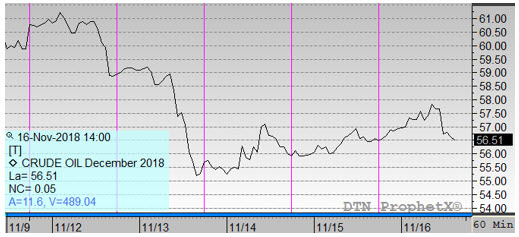

Crude oil began the week at $60.70, the last time the product would trade above $60/bbl for the remainder of the week. Monday’s huge sell-off left prices cratered, with markets unable to dig out of the hole. This morning, crude opened at $56.58, a loss of $4.12 (-6.8%).

Diesel prices also participated in a strong sell-off on Monday, shedding over 9 cents per gallon. Diesel opened the week at $2.1556 and opened this morning at $2.0768, a loss of 7.9 cents (-3.7%).

Gasoline prices, already hit hard by excessive supplies, saw losses midway between diesel’s light drop and crude’s large decline. Gasoline opened the week at $1.6367, lost 9 cents on Monday, and began clawing back their gains. This morning gasoline opened at $1.5555, a loss of 8.1 cents (-5.0%) this week.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.