Week in Review – February 17, 2023

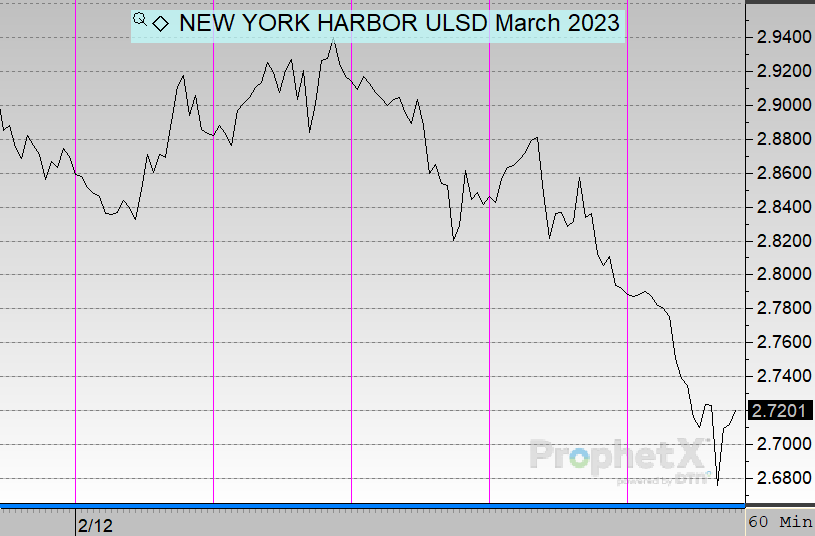

Oil prices are plummeting this morning, with diesel leading the way. Diesel plummeted into the $2.60s earlier this morning, one of the few times the product has seen that level since Russia invaded Ukraine. Heading into the long trading holiday weekend, markets are concerned about rising interest rates, since economic indicators continue to show a tight labor market.

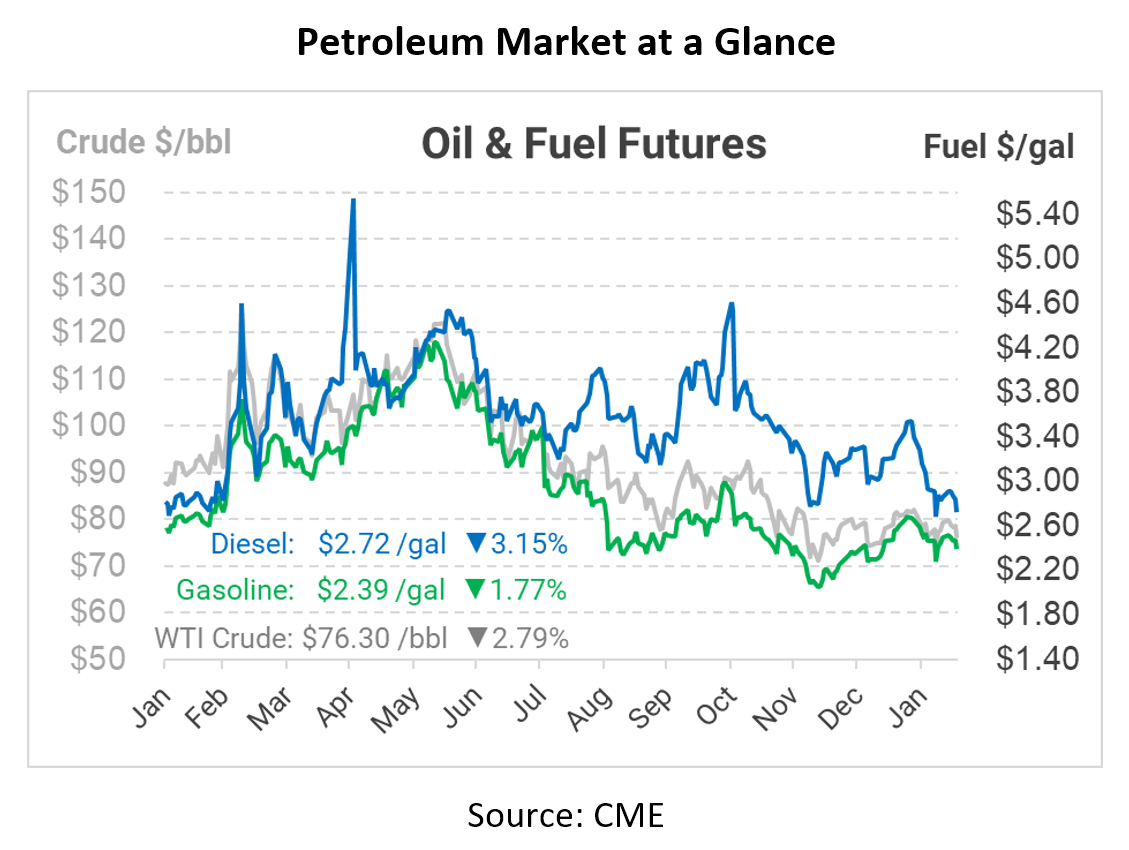

While the sense of supply emergency that permeated 2022 has eased, there’s still uncertainty on the direction of fuel prices. On one hand, JP Morgan now forecasts that Brent crude is unlikely to cross the $100/bbl threshold this year thanks to easing supply and reduced demand. On the other hand, Bloomberg recently reported that options traders are betting over $24 million that oil will surpass $110 by October. There are good arguments on either side. For companies heavily impacted by fluctuating fuel prices, the best approach may be to lock in a fixed price below your fuel budget, especially with the market hitting some 12-month lows.

The market downturn stems partially from economic data, including very low unemployment numbers and strong economic growth. It’s an unusual relationship – strong economic data would normally suggest higher prices, but right now the market is more worried that the Fed will continue to hike interest rates to reign in the overheated market. The means lower economic activity in the future, which the market is pricing in. Higher interest rates also makes risky assets like commodities less appealing than more stable bonds, so investors exit their oil trades – another form of demand reduction. Last, high interest rates in the US lead investors to invest in America, driving the US Dollar price higher which in turn makes oil more expensive for those trading in other currencies.

A notable inventory build reported by the EIA is also contributing to lower prices. Crude oil stocks rose by 16 million barrels last week, which is 3x-4x higher than a typical weekly inventory change. Gasoline also rose by 2.3 million barrels. Diesel stocks did fall slightly, which should be bullish, but since it’s fairly normal to see inventories fall early in the year, the market shook it off as typical.

As the local level, Colorado’s downed refinery looks like it may restart soon, though it will take weeks or months after restarting before supply conditions fully normalize. Ohio also faces continued supply pressure. Some refiners are planning downtime in the near future for maintenance and repairs, so we could see some local market fluctuations that don’t reflect in national prices.

Prices in Review

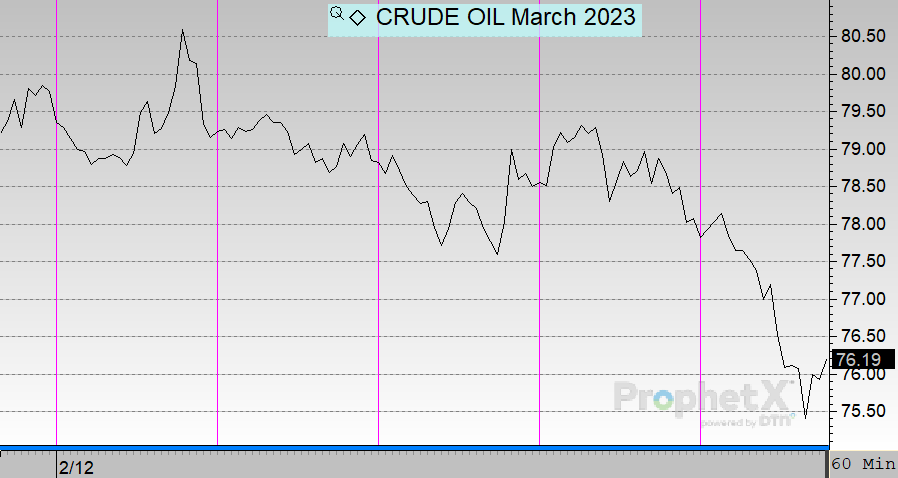

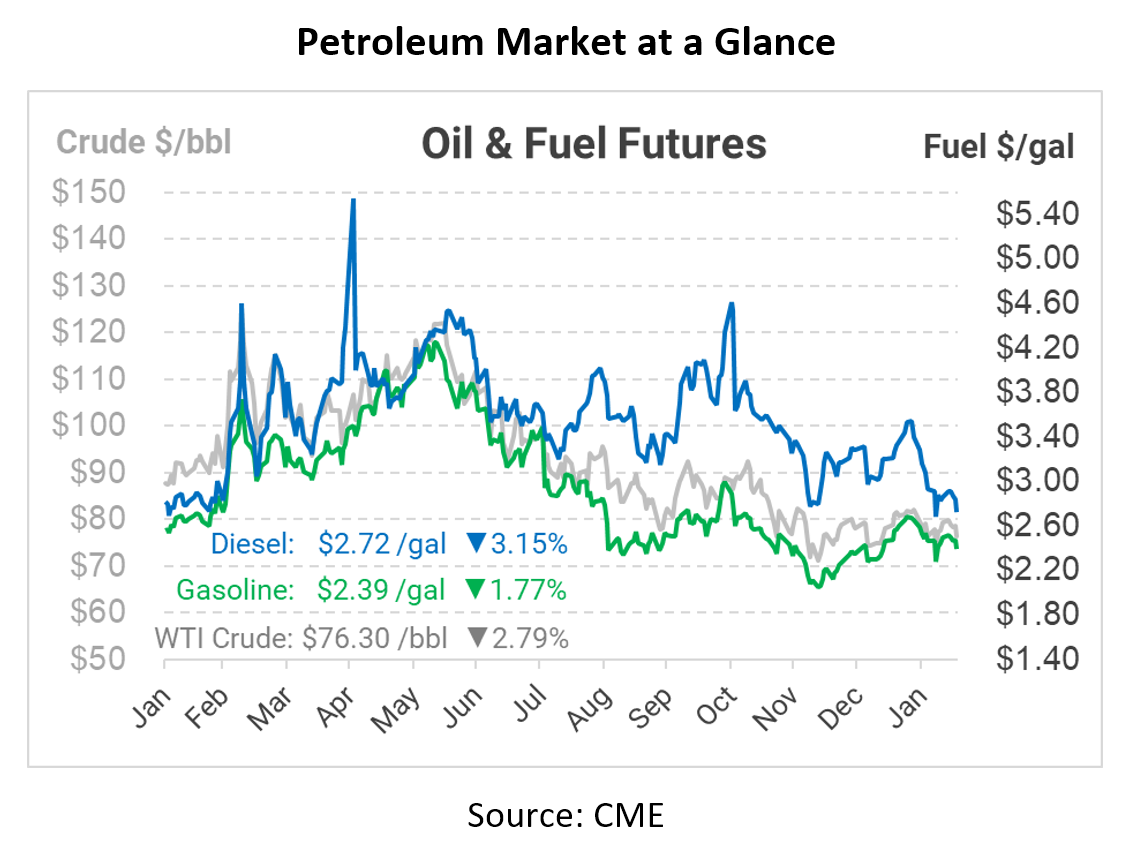

This week was mostly flat for crude oil, at east for the first four days. Crude opened at $79.94, and stayed within +/- $2 for most of the week. On Friday, crude opened at $78.07, a loss of $1.87 (-2.3%), and prices continued spiraling even further.

Diesel also saw a steep selloff on Friday, though its losses earlier in the week were more muted. Diesel opened at $2.87, climbed to a high of $2.94 on Tuesday, then began moving lower. By Friday, the product opened at $2.7950 for a weekly loss of 7.5 cents (-2.6%).

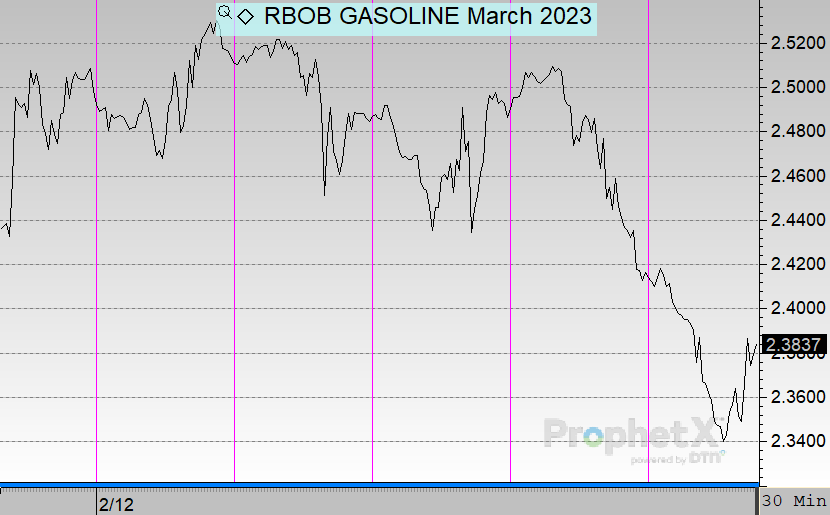

Gasoline was in line with crude, staying mostly stable during the week until late Thursday and Friday. Gasoline opened at $2.5065, gained a few cents on Monday, then began moving lower. On Friday, gasoline opened at $2.4192, down 8.7 cents (-3.5%).

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.