Week in Review

It’s been an eventful week for the market considering the overall lack of news. Markets have calmed from the OPEC announcements made last week and responded to a bearish inventory report that weakened prices on Wednesday. Yesterday’s announcement of Nigeria’s potential strike has been one catalyst for prices rallying higher at the end of the week.

The EIA mostly supported the API in their reported inventory stats this week, though the news was rather bearish for markets. There was a moderate inventory draw for crude, but a large combined build for refined products. A net inventory build combined with high refinery run rates sent prices on a downward spiral mid-week.

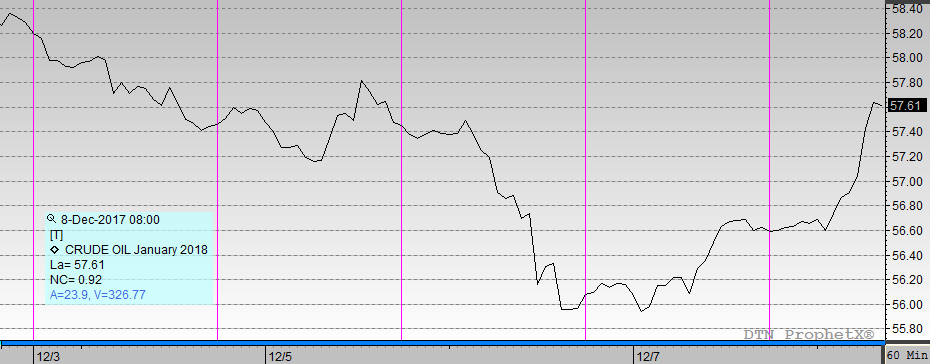

Crude oil prices are lower this week, beginning the week at $58.32 and opening this morning at just $57.63, a decline of 69 cents. Prices saw up-down-up movements on both Wednesday and Thursday thanks to the EIA and the threat of reduced production in Nigeria.

Prices fell drastically Wednesday as markets fully processed the EIA data, however they gained back most of their losses near the end of yesterday’s trading session. Monday saw diesel prices open at a strong $1.9383, the highest opening price of the week. Four days of losses followed, though today is on an upward trek which could potentially restore diesel to its early week prices.

Gasoline prices began the week at $1.7365, but like diesel, could not maintain its strength seeing huge losses on Wednesday closing at $1.6609, its lowest closing price since mid-October. Prices followed the oil complex trend for the week and rallied on Thursday, recovering some of its losses from a bearish EIA report. Today prices opened at $1.7206, just over a penny and a half under the weeks opening price to close the week lower.

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.