Weak Chinese Oil Imports Weigh on Market

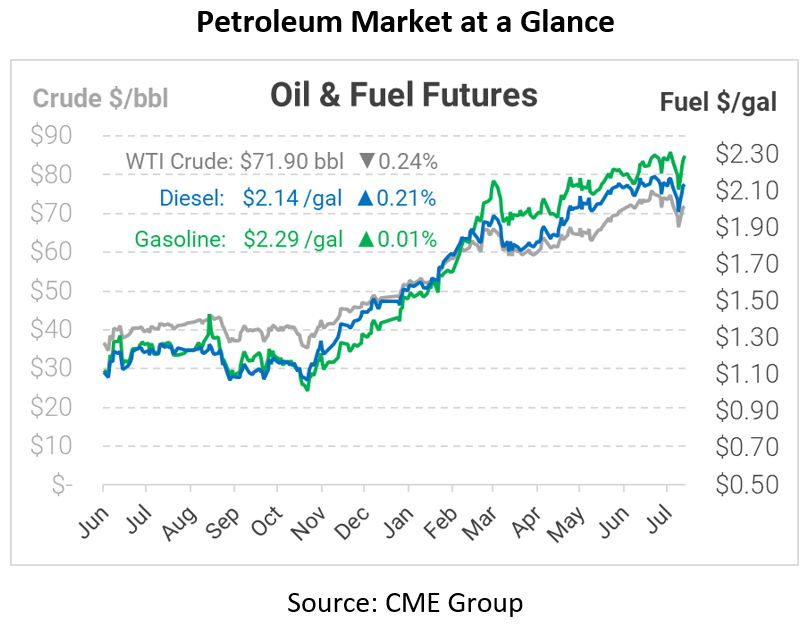

This morning, US crude oil prices are trading flat as traders continue monitoring new COVID-19 variants. Crude opened at $72.18, diesel at $2.1358, and gasoline at $2.2952. Markets are still locked in the continuing pattern – selling off due to COVID variants, then traders buy the dip and cause a surge in pricing.

Traders are particularly interested in China’s oil import growth, which is expected to fall to a 20-year low this year. In addition to slower economic growth due to COVID, the country is enacting stricter quotas to prevent so much foreign oil from entering the country. Although the US is the largest crude consumer, China is the world’s largest crude importer, since they have less domestic production capabilities. With China’s unquenchable thirst for oil seemingly weakened, those barrels must find a new home in the global market – driving down the costs of crude worldwide.

Last week saw some significant price volatility, with markets sinking due to OPEC production increases before rising again on strong demand. We know it will take months until the world can start to truly see the effects at the pump from OPEC’s decision. In the meantime, something else has been bothering many people in the COVID-19 variant space. Some overseas countries are starting new lockdowns as infection rates skyrocket, slowing oil demand growth in those regions. Unvaccinated populations are particularly at risk, and even a small fraction of the vaccinated population seems to be catching new COVID variants. With a large swath of the global population unvaccinated, there’s concern that lockdowns may once again become a dominant means of controlling outbreaks.

This article is part of Daily Market News & Insights

Tagged: China, COVID, oil prices

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.