U.S. Moves Toward Net Exporter – 4 Takeaways

As U.S. crude output rises, producers must find an outlet for their abundant products. While much of our crude can be refined domestically, a growing portion will need to be exported in the coming months as output rises.

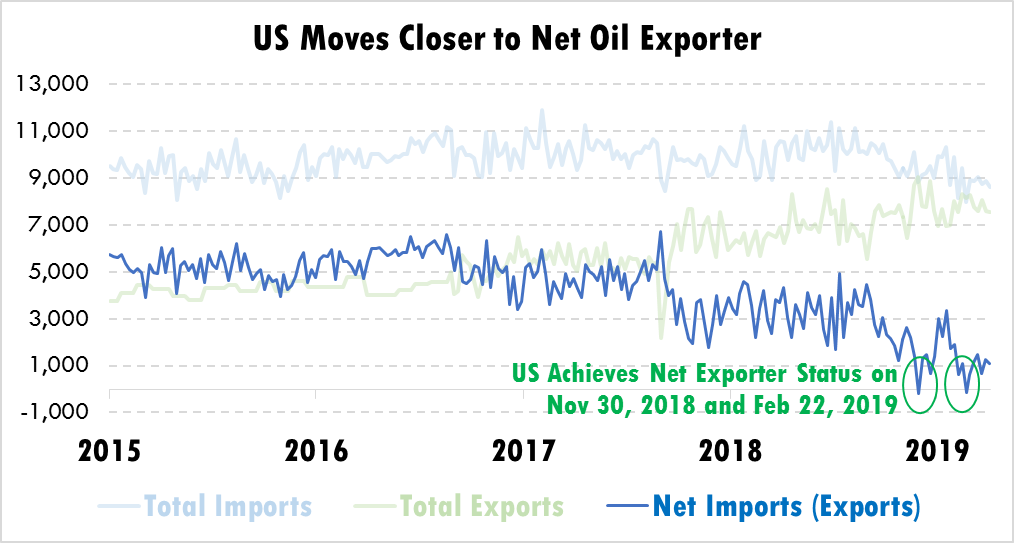

In Q1, the U.S. had so much product to export, we shipped out more than we brought in – making us a net oil exporter for the week of Feb 22, 2019. This was just the second time in U.S. history that we’ve achieved net exporter status, with the last occurrence in November 2018. Of course, both events were somewhat random in nature – weekly export data can be heavily influenced by the coming and going of just one or two massive crude vessels.

While we’re still on average importing around 1-3 MMbpd in any given week, energy agencies expect the U.S. to move more solidly into the net exporter category by the end of 2020. This would be a huge accomplishment for the largest consumer in the world to be statistically self-sustaining. Here are four things you should know about what it means for America to be a net oil exporter:

- Nationally, our economy will benefit from higher oil prices rather than lower oil prices. Of course, the benefit will not be universal. Low oil prices benefit consumers throughout the country, while high oil prices benefits a concentrated few companies and states with heavy production.

- We’re still tied to global oil prices. While we may export more than we import, that won’t mean we no longer require imports. For instance, the Northeast is heavily reliant on imports from Europe and other areas because the existing pipelines do not support heavy flows of U.S. oil into the region. We’re not done talking about OPEC just yet.

- Higher production levels will force a rush to build new export infrastructure. Today, only one port in the U.S., the Louisiana Offshore Oil Port, is capable of loading a crude supertanker. That number will have to rise to keep pace with supplies, meaning huge infrastructure investment in the coming few years.

- Unlike nearly every major net exporter around the world, the U.S. does not have direct state control over its producers. While the government can influence output through permitting, infrastructure investment and taxation, we have far less direct control than, say, Saudi Arabia to influence global prices. For global oil markets, that means less command-and-control style price influence, and more market-based economics.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.