US-China Near a Trade Deal

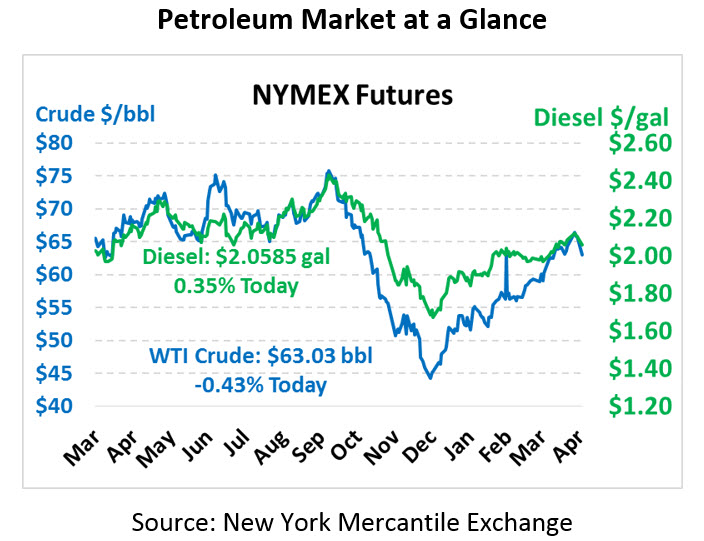

Friday saw oil prices retreat from the bull run that pushed prices to new 2019 highs, and this morning prices remain weaker. Trump’s tweet that he was personally lobbying OPEC to increase output seemed to rattle the market, though losses have cooled this morning. Crude oil is trading at $63.03 a loss of 27 cents.

Fuel prices are mixed but relatively flat in trading this morning. Diesel is trading at $2.0585, a fractional gain under a penny. Gasoline is trading at $2.0943 a fractional loss under a penny.

The US and China appear to be on the cusp of a trade deal, with trade teams meeting in Beijing this week and a Chinese delegation flying to DC on May 8. Treasury Secretary Steve Mnuchin believes talks are in “the Final Laps” and a deal should materialize soon. Stumbling blocks continue to center around Chinse industry subsidies and Iran sanctions, which the US intends to impose on China regardless of whether a deal is signed or not. A signed deal would give immediate support to both markets, leading to stronger economic growth and higher oil demand.

China, for its part, may continue purchasing some small quantities of Iranian oil despite US sanctions. Analysts expect the country might import 200 kbpd via barter, which would technically skirt sanction blowback. Russia and Saudi Arabia appear to be holding firm on OPEC+ production plans, agreeing to fill in lost OPEC production but not to exceed the set production quotas. The IMF recently reported that Saudi Arabia’s required break-even for oil to balance its government’s budget is $85/bbl, well above current price levels, so expect them to continue pushing oil prices higher.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.