US Adds 1.8 MM Jobs, Iraq Cuts Production – Markets Still Down

Oil prices are at a standstill this morning, continuing to slide back after reaching the highest crude oil price since early March. Much of the oil rally can be attributed to a falling dollar, so today’s small uptick in dollar strength is putting pressure on oil.

Outside of the dollar, though, today’s news seems generally bullish. The Bureau of Labor Statistics reported this morning that the US added 1.8 million nonfarm payrolls in July, well ahead of consensus expectations. The gains lowered US unemployment to just 10.2%, down almost a full percentage point from May.

Iraq announced today they would be cutting August and September supply by 400 kbpd, on top of previously announced cuts of 850 kbpd. Iraq is playing catch-up after months of exceeding quotas. According to OPEC, Iraq’s total output is roughly 4.5 MMbpd, so the incremental cuts would take 25% of the country’s oil off the market. Saudi Arabia has long threatened other OPEC members to comply with cuts or face a flood of Saudi oil production as a consequence. So far, Iraq has been pushing off deeper cuts to the future, but they may eventually have to follow through or encounter the wrath of the Saudi kingdom.

Finally, the NY Times reported that BP is making plans to divest oil assets over the next few years, even if oil prices move to more sustainable levels. Facing pressure from Britain, BP will be aggressively switching to renewables, reducing its oil and natural gas output by 1 MMbpd by 2030.

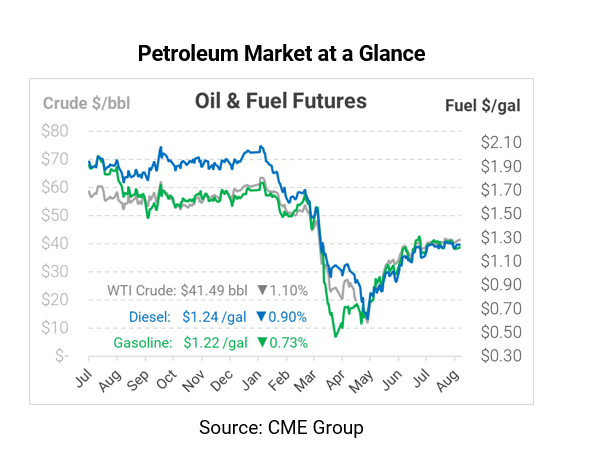

Despite the bullish news of US jobs and Iraqi oil cuts, the oil complex is moving lower this morning as the dollar strengthens. Crude oil is currently trading at $41.49, down 46 cents (-1.1%) from Thursday’s closing price.

Fuel prices are also falling back a bit. Diesel prices are $1.2386, a 1.1 cent decline. Gasoline prices are $1.2191, down 0.9 cents.

This article is part of Daily Market News & Insights

Tagged: Iraq, oil prices, opec, payrolls, rally

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.