The U.S. Gasoline Balance Softens, and Prices Slump

Crude and product prices took a sharp downturn recently. Prices fell by 2-3% in just a few hours following the release of the EIA’s weekly supply data. The data were not entirely bearish, so it is likely that the price drop was partly motivated by technical selling. Beyond this, however, we believe that the EIA data suggests unexpected softness in the gasoline supply and demand balance.

As Figure 1 below illustrates, gasoline stockpiling increased in January. Demand was seasonally low, and refineries also were gearing up for maintenance, so inventories were built up to prepare for refinery downtime. Many refineries entered maintenance in February and March. Refinery utilization rates declined to 85%-88% during this time. Gasoline inventories were steadily drawn down, falling from 259.1 mmbbls during the week ended February 10th to 236.1 mmbbls during the week ended April 7th. The stock build of 1.542 mmbbls for the week ended April 14th was not huge, but it came as a surprise and as a reversal of an eight-week trend. Gasoline futures prices fell in response.

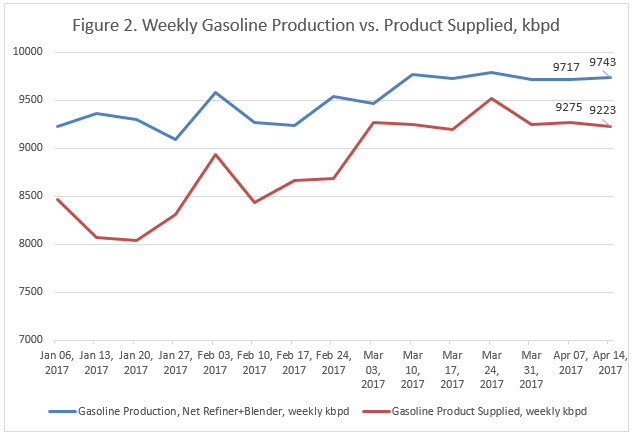

The week brought a slight widening of the gap between gasoline supply and gasoline demand, as shown in Figure 2 following. With refineries coming out of maintenance and preparing for the summer driving season, net production of gasoline by refiners and blenders rose from 9717 kbpd for the week ended April 7th to 9743 kbpd during the week ended April 14th, an increase of 26 kbpd. The EIA reported that refinery utilization rose to 92.9% during the week ended April 14th, up from 87.4% four weeks prior. Apparent demand for gasoline, however, fell from 9275 kbpd to 9223 kbpd week on week, a drop of 52 kbpd. Together, this adds to a surplus of 78 kbpd of gasoline during the week.

The difference between gasoline production and gasoline demand is shown next in Figure 3. In January and February, the supply overhang was typically 700-1200 kbpd. Surplus product was stockpiled or exported. In January, gasoline exports were over 900 kbpd, according to the weekly supply data, and the data on exports were finalized at 810 kbpd in the monthly data for January (the latest finalized data available from the EIA).

The largest contributor to the softening gasoline balance during the past week was imports. As Figure 4 shows, gasoline imports averaged 488 kbpd for the week ended April 7th, but imports jumped to 843 kbpd during the week ended April 14th—an increase of 355 kbpd. There are many possible reasons for a jump in imports, including weather, refinery issues, seasonal patterns, shifts in product specifications, distressed cargoes, and imprecise weekly data. These factors are at work in both the importing side and the exporting side. For some suppliers, it was economical to purchase supplies abroad and place them in storage.

Naturally, one week of data does not necessarily make a trend. Weekly data are estimates, not yet officially finalized. We recently conducted an analysis of the weekly data series and concluded that gasoline demand tended to be understated in the winter months and overstated in the summer months (see the author’s analysis in FUELSNews March 2, 2017.) Nonetheless, these weekly indicators show a softening of the gasoline balance:

- An unexpected addition to gasoline stockpiles,

- Additional refiner and blender output of gasoline,

- A drop in apparent demand

- Higher imports

The increase in gasoline output was to be expected, since refineries are coming out of maintenance. The drop in demand and sharp rise in imports could signal trouble, however. At this time of year, fuel suppliers expect demand to rise, not fall. Moreover, the huge surge in imports—if the data are correct—signal that demand may be weak elsewhere, such as in Canada, Europe, Russia and other countries that routinely export gasoline and gasoline blending components to the U.S. These exporters, just like U.S. suppliers, expect demand to start rising for the driving season. If other refining centers also face a widening gap between gasoline supply and gasoline demand, global gasoline inventories may remain stubbornly high, contributing to weak prices. In the U.S., at least, the longer-term forecasts call for a decline in gasoline demand. Refiners and marketers may look to this summer’s driving season and ponder whether the future is now.

This article is part of Gasoline

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.