Twitter Feeds Replace Fuel Price Feeds?

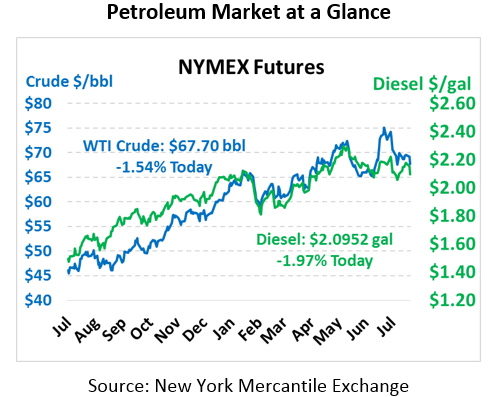

Prices are falling this morning in the wake of a bearish API report. Crude fell $1.29 during yesterday’s session, completely erasing Monday’s gains. This morning, crude is continuing its downward spiral, losing another $1.06 to trade at $67.70.

Fuel prices are also plummeting this morning with diesel leading the way lower. After the API reported a larger-than-expected build in diesel inventories, prices fell over 2 cents. Although gasoline stocks saw a small draw, prices also lost 2.5 cents. Diesel has given up an additional 4 cents this morning and is currently trading at $2.0952. Gasoline has lost 2 cents to trade at $2.0524 currently.

Overall, market-driving news is light this morning. News came out yesterday that the US is seeking to impose a 25% tariff on $200 billion worth of Chinese goods, up from the original 10% proposition. Oil saw its largest monthly drop in two years after yesterday’s sharp decline. As a whole, supply and demand are roughly balanced leaving traders sensitive to market-moving headlines. These conditions create the perfect environment for extreme volatility as the market can completely change direction based on a tweet.

The API reported mixed inventory results yesterday. Crude built by 3.2 MMbbls, surprising the market and driving prices lower. Gasoline was the only product that drew, but by less than the market estimated. Diesel built by 2.9MMbbls, bringing products to a net 2.8MMbbls build.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.