Traders Exiting Volatile Oil Market, Causing Price Boost

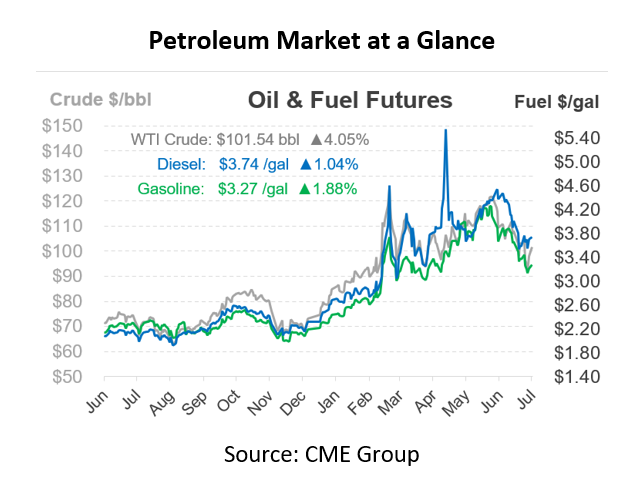

Oil prices are rising this morning as the market bounces back from last week’s sell-off. It appears this week’s rebound is due to trading factors rather than fundamental news influencing prices. In fact, there’s a decent bit of bearish news from this weekend – Libya plans to restore oil production fully, and President Biden ended his Middle East tour with no commitment from OPEC to increase supplies. But regardless of the fundamentals, trading data reveals why prices are jumping higher today.

American trading markets are highly transparent and regulated, and data from the CFTC (which regulates commodity trading) shows that both long and short oil trading volumes are declining. Put another way: regardless of whether oil traders believe prices will go up or down, they are exiting the market due to volatility and improving returns in bond markets as interest rates rise. Why gamble and possibly lose money trading oil when you can make a guaranteed 3% from treasury bonds – or more since the Federal Reserve is expected to raise rates again this month. Short trades (people betting oil prices will fall) decreased more than long positions last week, suggesting that markets don’t expect prices to fall much below the $95/bbl level seen last week.

Regarding Eastern Europe, Russia seems to be using its natural gas to increase pressure on Europe. Natural gas shipments have been offline for over a week due to a pipeline issue requiring repair – a normal enough occurrence. Although Russia argued that sanctions prevented its speedy repair, Canada has shipped Germany the parts needed to fix the pipeline. Despite repair work, Russia’s energy company Gazprom has not booked nat gas exports for August, suggesting outages could continue. At the same time, natural gas exports to China set a record daily high, according to a Reuters headline.

If Russia restricts natural gas exports, European energy prices will rocket higher. That could lead to more fuel switching for power generation, leading companies to rely on heating oil (diesel) for power rather than natural gas. During the winter, energy consumption increases significantly to keep homes and businesses warm, so prolonged natural gas outages could cause a large increase in diesel consumption this winter.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.