Today’s Market Trend

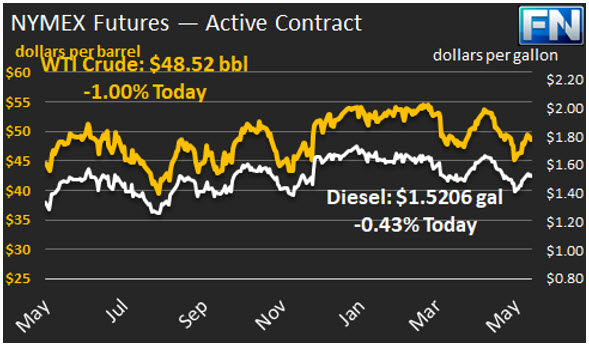

WTI crude prices have retreated to approximately $48.50/b this morning. WTI opened at $48.93/b today, an increase of $0.70, or 1.45%, above yesterday’s opening price. Current prices are $48.52/b, $0.55 below yesterday’s closing price. Prices yesterday opened weakly, but they rose upon a favorable set of supply and inventory data. However, both crude and product prices weakened overnight and in early morning trade.

Diesel opened at $1.5334/gallon this morning. This was a significant increase of 3.04 cents (2.02%) above yesterday’s opening price. Current prices are $1.5206/gallon, a decrease of 1.29 cents from yesterday’s closing price.

Gasoline opened at $1.5982/gallon today, up 0.54 cents, or 0.34%, from yesterday’s opening. Prices are $1.5815/gallon currently, a drop of 2.12 cents below yesterday’s close.

Prices are volatile as the markets react to swift-paced news headlines. At the fundamental level, prices received support yesterday when the Energy Information Administration (EIA) released its weekly supply report. The EIA data show across-the-board inventory drawdowns for the second week in a row—and the only two times this has happened all year. The EIA reported drawdowns of 1.753 mmbbls crude, 1.944 mmbbls diesel, and 0.413 mmbbls gasoline. The official EIA data reversed Tuesday’s price downturn, which began when the API data reportedly showed a crude stock build of 0.882 mmbbls, a diesel stock build of 1.8 mmbbls, and a gasoline stock draw of 1.8 mmbbls.

U.S. crude inventories have now decreased for six weeks running. This is a major turnaround from the first quarter, when stockpiles grew every week except for one (and the drawdown that week was a mere 0.24 mmbbls.) During the first quarter of 2017, crude inventories expanded by 52.4 mmbbls. In contrast, during the second quarter to date (through the week ended May 12th,) stockpiles have been reduced by 12.6 mmbbls.

Moreover, U.S. crude production dipped by 9 kbpd during the week ended May 12th. This broke a streak of twelve weeks with production increases.

Although U.S. total product demand declined during the week, demand for the key fuels gasoline, jet fuel and diesel crept up.

Therefore, the U.S. fundamentals are supportive of prices this week. The price weakness countering this is most likely caused by political turbulence surrounding the Trump Administration. The Justice Department appointed a special counsel, ex-FBI Director Robert Mueller, to oversee the investigation into the Russia issues. Members of Congress are seeking testimony from fired FBI Director James Comey regarding his memo alleging potential obstruction of justice by the president. The Dow Jones Industrial Average tumbled 377 points in the past two days.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.