Today’s Market Trend

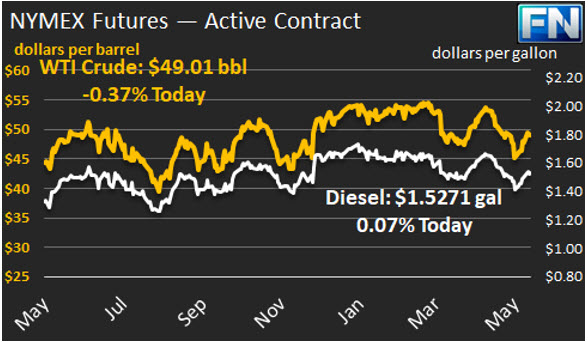

WTI crude prices are back in the vicinity of $49/b this morning, with yesterday’s downturn reversing this morning. WTI opened at $48.23/b today, a drop of $0.59, or 1.21%, below yesterday’s opening price. Current prices are $49.01/b, $0.35 above yesterday’s closing price. Crude and product prices had strengthened for four consecutive sessions until the streak was broken this morning, but both crude and product prices have recouped some of their losses since market opening.

Diesel opened at $1.503/gallon this morning. This was a decline of 0.71 cents (0.47%) below yesterday’s opening price. Current prices are $1.5271/gallon, an increase of 1.07 cents from yesterday’s closing price. Like crude, diesel prices had opened higher four sessions in a row until the current session.

Gasoline opened at $1.596/gallon today, up 1.75 cents, or 1.11%, from yesterday’s opening. Prices are $1.6125/gallon currently, an increase of 0.82 cents above yesterday’s close. Gasoline prices had risen in the last four trading sessions until today’s.

The recent price rally began last week when the Energy Information (EIA) released its weekly supply report, showing crude and product inventory drawdowns. Prices received another boost when the Saudi Arabian and Russian Energy Ministers announced support for a nine-month extension to the OPEC-NOPEC production cut agreement. U.S. production and the active rig count, however, continued to rise, indicating that the supply overhang would persist.

The price rally flagged yesterday upon the release of the API’s report on inventories. The market had anticipated a drawdown of both crude and products. However, the API data reportedly showed a crude stock build of 0.882 mmbbls, a diesel stock build of 1.8 mmbbls, and a gasoline stock draw of 1.8 mmbbls. The EIA will release official data later today.

Uncertainty about U.S. leadership is impacting markets. The White House is in what one senator called a “downward spiral.” President Trump is scheduled to make his first major trip abroad beginning tomorrow, but relations are strained with many allies. The U.S. Dollar has fallen in the last four trading sessions. In general, a lower U.S. Dollar is supportive of oil prices, but the relationship is not one-for-one.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.