Today’s Market Trend

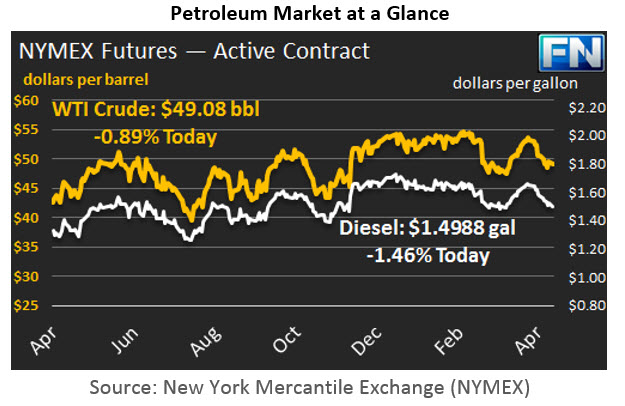

WTI crude prices are holding just above $49.00/b this morning. Friday brought a short-lived rally which brought prices up to around $49.75, but the market closed at $49.33/b. WTI opened at $49.17/b today, down by $0.10, or 0.20%, from Friday’s opening price. Current WTI prices are $49.08/b, a continued decline of $0.25 from Friday’s closing price.

Diesel opened at $1.5062/gallon in today’s trading session. This was a drop of 1.0 cents (0.66%) below Friday’s opening price. Current prices are $1.4988/gallon, down by 0.84 cents from Friday’s closing price. Diesel prices have been on a downward slope, opening lower for eleven of the past twelve trading sessions. Diesel prices have shed 14.83 cents, or 9.0%, since April 12th.

Gasoline opened at $1.5481/gallon today, down 0.72 cents, or 0.46%, from Friday’s opening. This was the lowest opening price since February 28th. Prices are $1.5446/gallon currently, a decline of 0.35 cents from Friday’s close. Gasoline prices have decreased in eleven of the past twelve trading sessions, declining by a total of 21.58 cents, or 12.2%, since April 12th.

Friday’s brief price rally was motivated in part by the news that the OPEC-Non-OPEC production cut agreement achieved a compliance rate calculated at 98% for the month of March. Russia announced that it has now fully met its commitment to cut 300 kbpd of crude supply. Saudi Arabian Oil Minister Khalid al-Falih noted that he planned to visit Moscow soon to gain Russia’s support for the extension as well.

Although the market seems to be giving considerable credence to the OPEC-NOPEC production cuts and the prospect of an extension to the agreement, the supply overhang is persistent. The Baker Hughes Rig Count released on Friday showed an addition of 13 rigs for the week ended April 28th, bringing to count to 870. This is the fifteenth consecutive week that the rig count has increased. Since the week ended January 6th, 205 rigs have been activated. U.S. crude production and the active rig count rose again last week against a backdrop of steadily decreasing prices, leading to the question, How low do oil prices have to fall again before U.S. production falls?

Markets were also shaken by the release of Chinese economic data that fell short of essentially all key analyst forecasts. The Chinese economy has been growing rapidly, some say too rapidly. The government is working to tighten monetary policy and strengthen regulation, which may moderate growth rates in upcoming months.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.